Although a million dollars isn’t what it once was, it would be a significant improvement for most of us. Additionally, if you can save a million dollars, you can keep two or three million. Are you able to make such savings?

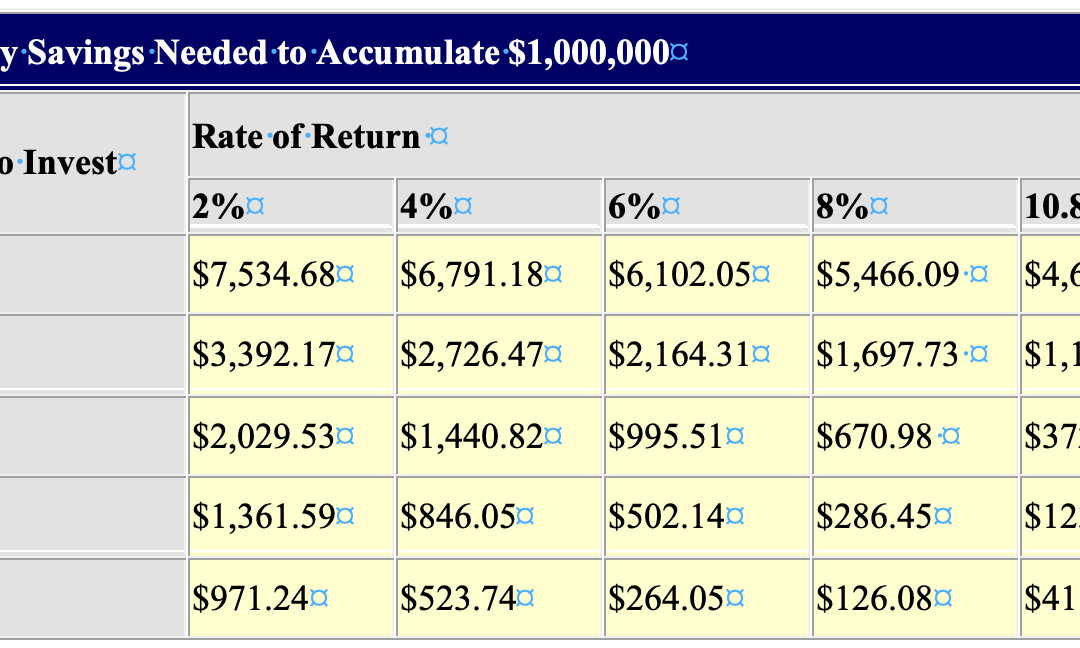

Everything is conceivable. Time is of the essence when it comes to saving a specific quantity of money. Let’s look at a table to determine how much money would need to be set aside each month to save $1,000,000:

As you can see, you need to save less money each month the earlier you start. To save a million dollars in 50 years, you just need to save $126.08 every month at an 8% return. But to achieve the same goal in 10 years, you must save roughly $5,500 every month. Ouch. It makes sense, but you’d be surprised at how much more you’d need to save if you waited.

Likewise, the rate of return grows more significant the longer the investment time is. Look at the 10-year time frame; the difference between the required savings amounts at 2% and 8% (around 38% more) isn’t that great. The difference between the two equivalent values at 50 years is just over 670%.

Thus it’s best to start saving as soon as you can and try to acquire the highest return rate possible.

But let’s be realistic—few of us have the insight to begin saving when we are 15 or 20. We constantly believe that there will be time for it later since we have more pressing matters to attend to.

Instead, let’s imagine that you have a 30 year time frame. Long-term, it is reasonable to anticipate a return of 10.8%; this is the historical return of the stock market. As you can see, that would necessitate $373 in monthly savings. We have now entered a zone that may be extremely realistic for you.

A few things to remember are:

- Employer matching contributions should be used. The first place to look for assistance is here. Your 401(k) matching contributions are like a raise. You will receive money from your employer in addition to pre-tax payments from yourself.

- Utilize accounts that are tax-deferred. The figures above presuppose that you are exempt from paying taxes on your profits as they accrue. This necessitates a concentration on 401(k), IRA, and comparable accounts.

- Don’t touch the money! In 30 years at a 10.8% rate, every dollar you save is worth $25.16. Over time, every dollar you spend will cost you a lot. Hence, that $20 trinket you simply must have ends up costing you more than $503.20. Always invest in items that you either either need or genuinely adore.

- Have patience. Towards the end, your savings increase significantly more quickly than they did at the beginning.

For the majority of people, saving a million dollars is easily doable. The main problem is time. Over time, even someone with a smaller income can build up significant wealth. This indicates that now is the moment to start, not tomorrow or even next year.

You’ll be happy with the outcomes if you start saving right away. While a million dollars may not be as valuable as it once was, it’s still not bad.