How to Simplify Your Budget

Budgeting is a crucial financial tool that empowers individuals and households to manage their money effectively, achieve financial goals, and maintain financial stability. However, for many people, the thought of budgeting can be intimidating and overwhelming. The...

4 Methods for Eliminating Overdraft Charges

Overdraft charges can be a frustrating and costly experience for many consumers. These fees occur when you spend more money than you have in your bank account, resulting in negative balances and penalty fees from your bank. Fortunately, there are several methods you...

Financing Your Child’s Private School Tuition

Title: Investing in Education: Financing Your Child's Private School Tuition Choosing to send your child to a private school is a significant investment in their education and future. While private schools offer exceptional learning environments and opportunities, the...

Mastering Financial Clarity: Tracking Business Expenses as an Entrepreneur

As an entrepreneur, managing your business expenses is a critical component of maintaining a healthy financial foundation. Keeping a close watch on your expenses not only ensures that you stay within budget but also provides valuable insights into your business's...

Master Your Finances: Top Money Management Tools of 2023

Managing your money effectively has become more crucial in an increasingly complex financial landscape. Thankfully, technology has kept pace with this demand, offering powerful money management tools to help you take control of your finances. Whether you're tracking...

How to Save Money to Purchase Your First Home

Saving money to purchase your first home is a significant financial goal that requires careful planning and discipline. While it may seem daunting, with the right strategies and mindset, you can achieve your dream of homeownership. In this guide, we'll provide you...

Escaping Bank ATM Fees: Tips to Keep Your Money in Your Pocket

Escaping Bank ATM Fees: Tips to Keep Your Money in Your Pocket Bank ATM fees can quickly add up and eat into your hard-earned money. However, with some strategic planning and smart choices, you can avoid or minimize these fees and keep more money in your pocket. In...

Keeping Good Financial Records for Your Small Business: A Comprehensive Guide

Keeping Good Financial Records for Your Small Business: A Comprehensive Guide Maintaining accurate and organized financial records is crucial for the success and growth of any small business. Good financial records not only help you track income and expenses but also...

The Pros and Cons of Being an Authorized User on Credit Card Accounts

The Pros and Cons of Being an Authorized User on Credit Card Accounts When it comes to building credit or managing finances, becoming an authorized user on someone else's credit card account can be an option worth considering. Being an authorized user allows you to...

Negotiating a Lower Interest Rate on Your Credit Cards: A Step-by-Step Guide

Negotiating a Lower Interest Rate on Your Credit Cards: A Step-by-Step Guide Paying high-interest rates on credit cards can be a significant financial burden, making it challenging to pay off debt and achieve financial goals. However, with the right approach, you can...

Managing Maxed-Out Credit Cards: Steps Toward Financial Recovery

Managing Maxed-Out Credit Cards: Steps Toward Financial Recovery Maxing out credit cards can be a stressful and overwhelming situation, leaving many individuals feeling trapped in a cycle of debt. However, it's essential to remember that you're not alone, and there...

Banking the Smart Way: Tips for Financial Success

Banking the Smart Way: Tips for Financial Success Banking is an integral part of our daily lives, and the way we handle our finances can significantly impact our financial well-being. Whether you're just starting your financial journey or looking to optimize your...

Managing Money Stress: Strategies for a Harmonious Home

Managing Money Stress: Strategies for a Harmonious Home Money is an undeniable aspect of our lives, and its impact on our well-being extends beyond our bank accounts. Financial stress can seep into our homes, affecting relationships, emotions, and overall happiness....

Building Strong Foundations: The Importance of Teaching Your Young Teen about Money

Title: Building Strong Foundations: The Importance of Teaching Your Young Teen about Money Introduction As parents, we strive to equip our children with essential life skills to navigate the world successfully. While academic knowledge is crucial, teaching children...

Mastering Your Money Matters: A Comprehensive Guide to Financial Success

Title: Mastering Your Money Matters: A Comprehensive Guide to Financial Success Introduction In our fast-paced and ever-changing world, money plays a crucial role in shaping our lives. Whether we like it or not, financial matters are an essential aspect of daily...

How Does Consumer Counseling Work

Consumer Counseling Work is ideal for people overwhelmed by their debts. A credit counselor will help you to get your finances under control. Before choosing a counselor, you should ensure they are BBB accredited. A credit counsel is supposed to set you on a debt...

Ideas to Income

Turn Your Ideas into Income: Advice From The Pros When it comes to success, millennial women aren’t afraid to challenge black-and-white definitions since they know they can design their color palette. This is why more Americans today are starting their own business....

How to Save Money on Small Business Taxes

One of the major ways to save funds in your enterprise is through intelligent tax financial savings. Each yr, many tax deductions are provided by the IRS, which can not solely reduce your taxable but can also reduce the income related to the self-employment tax....

Get Ahead in Business: Understanding Essential Accounting Terminology

How frequently do entrepreneurs speak to their accountants and feel even more confused than they have been earlier? This is most likely the case with several entrepreneurs and managers without a background in enterprise or accounting. To aid business owners through...

4 Exit Strategies for Start-ups to Follow

Entrepreneurs yearn for the struggle to manage their own companies. The battle often leads to many benefits but can sometimes lead to a corridor of endless darkness. Thus, while launching your well-thought-out startup, you must plan a sparkling exit strategy for the...

Advantages and Disadvantages of Automatic Bill Pay

One of the great benefits of online banking is automatic bill paying. Your bills are paid automatically on a preset date each month. A checking account or credit card can be used as a payment source. If you struggle to pay your bills on time or can't find the time to...

8 Financial Considerations When Starting a New Job

Getting a job offer is always an exciting time. Whether you’re getting your first job, a promotion, or changing careers, there’s a lot to be happy about. But it’s always wise to consider the financial aspect of any decision; starting a new job is no exception. Before...

7 Hidden Benefits of Using a Credit Card

Credit cards come with several hidden benefits. Are you aware of some of the perks of using your card? Credit card companies offer multiple bonuses to help you get the most out of your card. Check the terms of your credit cards for these benefits: Roadside assistance....

6 Techniques to Educate Your Children About Money

Children can benefit from financial education at an early age. Researchers share it's crucial to start primary finance education by age 3. A study from the University of Cambridge, “Habit Formation and Learning in Young Children,” found that money habits are formed by...

4 Tips to Boost Your Retirement Savings

You’re aware that it's essential to save for your retirement. For most of us, 100% employer-funded pensions are long gone, and Social Security is only designed to offset a portion of your pre-retirement income. Most financial advisors recommend that workers save...

All You Need to Know About Investing in Real Estate

Investing became increasingly alluring as the pandemic spread because of how quickly it might generate wealth. In these challenging times, investing money will help one beat inflation. To start, consider making several investments. For people just starting, stocks,...

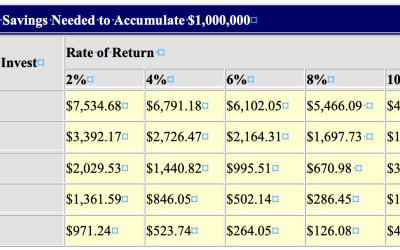

Accomplish Your Goal to Save a Million Dollars

Although a million dollars isn't what it once was, it would be a significant improvement for most of us. Additionally, if you can save a million dollars, you can keep two or three million. Are you able to make such savings? Everything is conceivable. Time is of the...

26 Ways to Build Your Savings Account

Start with the 52-Week Challenge. A simple method to start saving more money is to take the 52-week savings challenge. Saving money is so simple that you'll unlikely notice it. Put $1 in a piggy bank or savings account to begin during the first week of January. Then,...

21 Tips for a $1,000 Monthly Savings Account

Building up a healthy savings account is one of the finest methods to control your finances in today's unstable economy. Nobody wants to experience the anxiety of being only one or two paychecks away from financial ruin due to a lack of reserves for when "something...

12 Highly Effective Ways to Make Money Online

Find freelance work. Working for yourself and completing jobs under contract is known as freelance work. You are still self-employed when you work as a freelancer, even if you sign a contract to work for an organization. Also, there are many internet freelance...

9 Ways to Easily Increase Your Retirement Savings

Everyone wishes they had started saving for retirement sooner. If you're in this situation, saving more is the only way to catch up. Saving for retirement doesn’t have to be painful or challenging. There are many strategies to increase your savings each month without...

Boost Your Retirement Savings

You’re probably well aware that saving for retirement is essential. For most of us, 100% employer-funded pensions are long gone, and Social Security is only designed to offset a portion of your pre-retirement income. Most financial advisors recommend that workers save...

4 Methods for Eliminating Overdraft Charges

Overdraft fees can be real killers. To add insult to injury, you’re charged a considerable amount of money as a penalty. You likely already have some financial challenges to get into that situation in the first place. Banks are growing more reliant on these fees....

A 5-Step Plan to Dealing with Student Loans

The nation's student loan debt is over $1 trillion and is more significant than its collective credit card debt, but there are also 5 million ex-students who are delinquent with their payments. Student loans are unique because they're among the few debts not...

Build Your Savings with Easy Spending Cuts

If you must learn to reduce your everyday spending, saving money can be very challenging. You'll be shocked to see how much money you may save once you've decided to make daily budget cuts! The following advice will make it simple for you to go closer to your...

Saving Time and Money for the Everyday Entrepreneur

For businesses, the time value of money is a crucial financial factor. Inflation, risk concerns, prospective investment returns, and loan interest influence business decisions. In essence, you contrast the worth of the money you have right now with the relative...

Managing Your Finances

Before discussing managing your finances, let's consider what prevents you from becoming financially independent. Are you struggling with your debt and attempting every option? Does having financial independence suddenly seem more like a luxury? Debt freedom is a...