As an entrepreneur, managing your business expenses is a critical component of maintaining a healthy financial foundation. Keeping a close watch on your expenses not only ensures that you stay within budget but also provides valuable insights into your business’s financial health and growth potential. In this blog, we’ll delve into effective strategies and tools to help you stay on top of your business expenses, streamline your financial processes, and set the stage for success.

1. **Create a Dedicated Business Account**

Separating your personal and business finances is essential. Open a dedicated business bank account to ensure that all your business transactions are centralized and easy to track. This separation simplifies record-keeping and prevents confusion when categorizing expenses, making it easier to prepare accurate financial statements come tax time.

2. **Digital Expense Tracking Tools**

Embrace technology by using digital expense tracking tools tailored for entrepreneurs. Apps like QuickBooks, FreshBooks, and Expensify offer user-friendly interfaces that help you record expenses, categorize them, and generate detailed reports. These tools can automate data entry, reducing the likelihood of manual errors and saving you time.

3. **Organize Receipts Digitally**

Say goodbye to the hassle of paper receipts piling up in your workspace. Utilize apps like Evernote, Shoeboxed, or Adobe Scan to capture and store digital copies of your receipts. This practice not only saves physical space but also makes it easier to search for and retrieve receipts when needed.

4. **Set Up Expense Categories**

Establish a clear and detailed system of expense categories that align with your business’s activities. Categories might include marketing, office supplies, travel, utilities, and more. Assign each expense to the appropriate category as soon as it’s incurred to streamline the tracking process and gain a comprehensive view of where your money is going.

5. **Regularly Reconcile Accounts**

Frequently reconcile your business accounts to ensure that your recorded expenses match your bank statements. This practice helps identify any discrepancies or errors early on, preventing financial confusion down the line. Reconciliation also aids in spotting potential fraudulent activities and maintaining the accuracy of your financial records.

6. **Implement a Receipt Approval Process**

If you have employees or contractors making business-related purchases, establish a receipt approval process. Require them to provide receipts and detailed explanations of their expenses before reimbursement. This not only encourages responsible spending but also adds an extra layer of accountability.

7. **Schedule Regular Expense Reviews**

Set aside time on a weekly or monthly basis to review your business expenses. Analyze spending patterns, identify areas of overspending, and make informed decisions about where to cut back or allocate more funds. Regular expense reviews also allow you to gauge the effectiveness of your budgeting strategies.

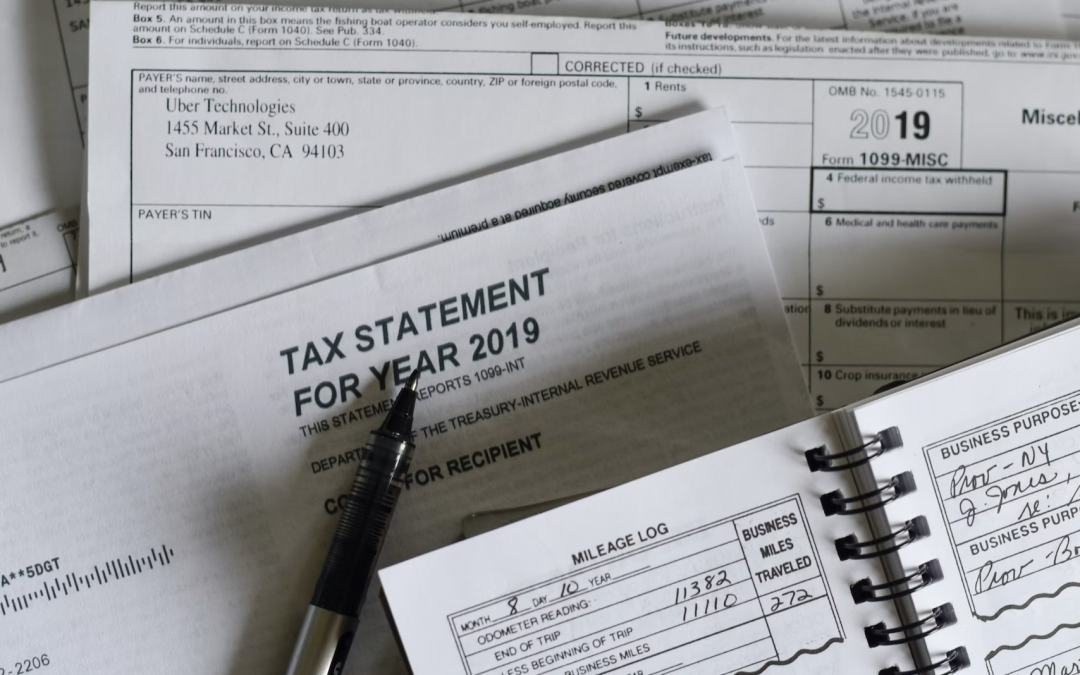

8. **Plan for Taxes**

Don’t wait until tax season to organize your expenses. Throughout the year, keep track of deductible expenses, such as office supplies, travel expenses, and professional services. This proactive approach makes tax preparation less overwhelming and maximizes your potential deductions.

Maintaining a clear record of your business expenses is a fundamental practice that contributes to the success of your entrepreneurial journey. By establishing organized processes, leveraging digital tools, and staying vigilant about tracking your spending, you’ll gain a deep understanding of your business’s financial landscape. This knowledge empowers you to make informed decisions, optimize your budget, and ultimately pave the way for sustainable growth and profitability. Remember, the effort you invest in tracking your business expenses today will pay off in the form of financial clarity and a solid foundation for the future.