by Andrea Carson | Apr 5, 2023 | Make Money

Investing became increasingly alluring as the pandemic spread because of how quickly it might generate wealth. In these challenging times, investing money will help one beat inflation. To start, consider making several investments. For people just starting, stocks, bonds, and mutual funds are the most well-liked and often-used investments.

Real estate is a crucial choice for assuring a bright retirement future because it carries less risk and less volatility than the stock market. Because land and property values increase over time, it can be the best option for people wishing to invest long-term. Other assets like real estate can also be a reliable source of cash flow in addition to those mentioned above.

Real estate investing might be challenging, but the goal is to see a return on your investment eventually. Before agreeing to such a significant capital investment in real estate, an investor should consider a few risks and considerations.

An investor should be aware of the following while dealing with real estate:

- The kind of property you wish to emphasize

There are four primary categories of real estate. Residential, commercial, industrial, and retail properties fall under this category. The most secure sort of real estate to invest in is residential. This is due to the guarantee of the rate of return. The shelter is one of our fundamental requirements. Hence people are constantly looking for homes to rent. As a result, you will always be able to rent out your residential home.

In contrast to the other varieties, residential real estate has a lower profit margin. More considerable profit margins are offered by commercial, retail, and industrial assets. In challenging economic circumstances, there is a substantially greater chance of vacancy or nonpayment of rent.

- You should have a consistent personal income.

Real estate investing requires a monetary commitment. In the beginning, it might take more from you than it gives. Hence, you must ensure that you have a reliable source of income to help you get through the difficult financial time between buying and selling a property. As a general rule, determine whether you are currently using surplus funds. Likewise, establish an economic prediction for the next six months of your life. Will your income be consistent at this time? If the answer is yes, you are financially sound enough to invest in real estate. If not, first, take care of your finances.

- How much money do you need to make a property investment?

Before turning a profit on your real estate endeavors, you should have access to significant sums of money to stay afloat. If you acquire a house to sell, you may be required to make specific improvements before the sale. Also, if you’re purchasing a foreclosed home, you’ll need cash to cover the mortgage. Your available money should therefore be one of the factors you consider as you start investing in real estate.

- What is your credit score right now?

This score is a significant factor that impacts the interest rate you receive for your mortgages. A difference of just a few points in your credit score might affect your mortgage by $1,000. Hence, ensure you have a good credit score before taking out a mortgage to purchase residential real estate. If everything is ok, you may proceed. Find a way to elevate it if necessary.

- Choose the appropriate mortgage product.

While making a residential real estate investment in a home, you could occasionally take out a mortgage on it. This is especially true if you flip a house after briefly owning it. It also applies if you plan to reside in the home you bought only shortly before selling it. An adjustable-rate mortgage is the best mortgage to use in such a situation. This particular mortgage provides a low introductory rate fixed for five years. It is changed and raised after that period. Also, adjustable-rate mortgages are typically cheaper than fixed-rate mortgages. As a result, you can use an adjustable-rate mortgage to invest in residential real estate to sell it before the first adjustment. This permits you to make an excellent return. A fixed-rate mortgage is suggested if you plan to make a long-term investment.

- Location matters a lot

In the world of real estate investing, location is everything. The most crucial factor to consider is the location of your investment. Always do extensive study on the sector where you intend to make investments. Is it secure? Exist nearby transportation hubs? Are there any commercial hubs close by? What about educational facilities? Always think about these aspects before investing in real estate.

- The property’s attributes

The state of the property you want to buy is a crucial factor to consider. Beautiful infrastructure, such as asphalt roads, street lights, effective drainage systems, and well-built pavements, is typically present around attractive land or buildings. Additionally, appealing homes usually feature a functional layout, sound structural integrity, an open floor plan, and extras like balconies and grilling areas on the patio. While buying real estate, keep an eye out for these characteristics. This is because a piece of property or a home’s features can draw or turn away tenants. As a result, choose those with appealing attributes to receive a substantial return.

- Take into account the viewpoint of the prospective tenant.

The consumer is always right in business. This tenet also covers real estate. Consider your intended tenant’s viewpoint when building a home to rent it out or sell it. Consider what would appeal to them, then use that in your growth. You can also use this element to buy a piece of land to sell it later. What features might appeal to a potential buyer? This will assist you in making strategic enhancements that will draw customers and ensure profitable investment.

- The tenant’s profile

Few residential real estate investors consider the kind of tenant they choose. Many people merely desire someone who pays their rent on time. But a tenant is much more than someone who can pay rent on time. The type of tenant you accept is a crucial thing to consider. It would be best to look for a trustworthy, mature, and responsible tenant with a solid rental history. Before allowing a tenant to live on your property, you can take the time to interview them. This guarantees that your residential investment won’t cause any issues.

- The state of the real estate market at the moment

The state of the real estate market might fluctuate. They play a crucial role in real estate investment. High property values are a beneficial condition for selling a home. Conversely, if property values are low, now is an excellent time to buy rather than now being the wrong time to sell. As a result, do some market research to understand the current market conditions before investing in real estate.

Real estate investment is the financial commitment made to a piece of property to earn income through a lease or rental with the long-term goal of capital growth. Real estate consists primarily of land, any land improvements, and the rights acquired with it, such as the right to hold and transfer property. Real estate investment is a long-term venture that requires significant financial resources and can be highly unpredictable. Hence, it would be best to exercise caution when investing in one. I also hope that this post will be helpful to you as you travel.

by Andrea Carson | Mar 29, 2023 | SAVE MONEY

Although a million dollars isn’t what it once was, it would be a significant improvement for most of us. Additionally, if you can save a million dollars, you can keep two or three million. Are you able to make such savings?

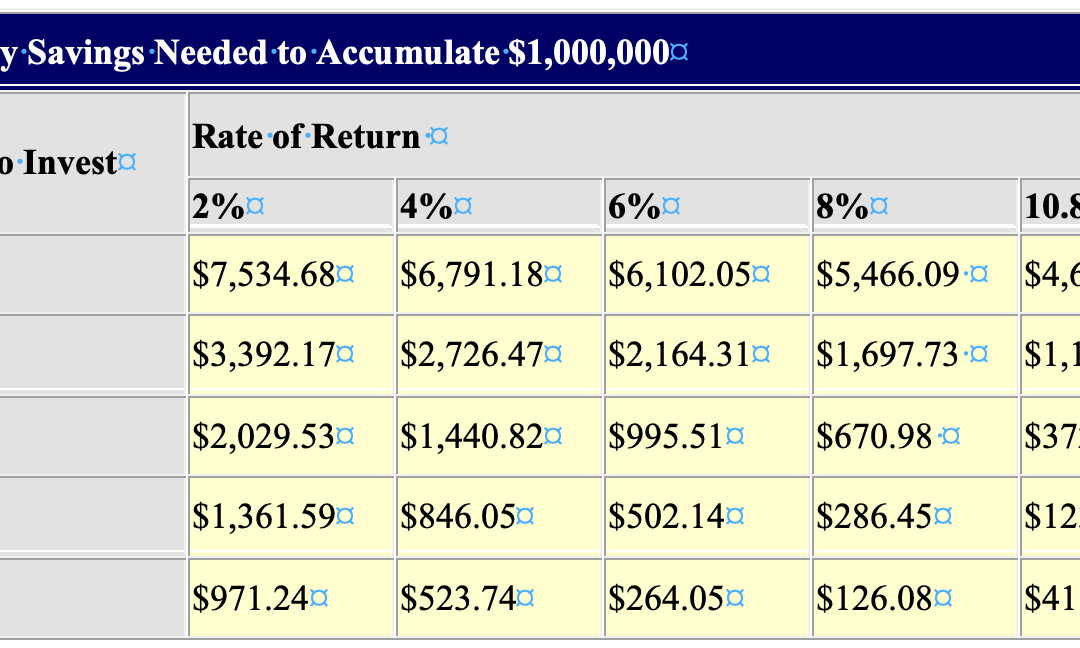

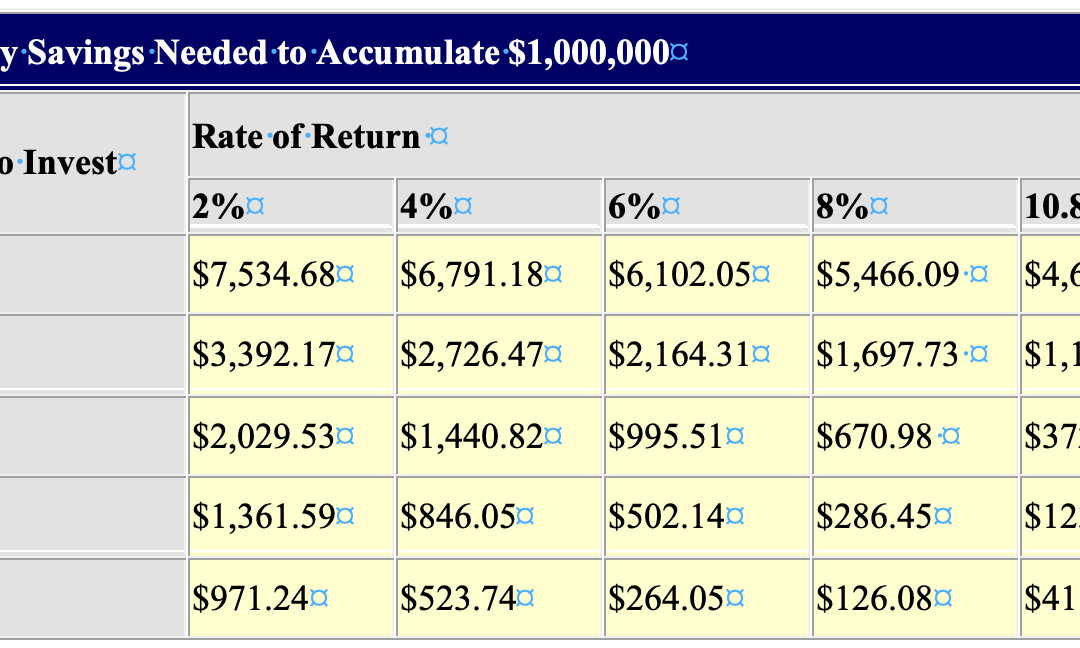

Everything is conceivable. Time is of the essence when it comes to saving a specific quantity of money. Let’s look at a table to determine how much money would need to be set aside each month to save $1,000,000:

As you can see, you need to save less money each month the earlier you start. To save a million dollars in 50 years, you just need to save $126.08 every month at an 8% return. But to achieve the same goal in 10 years, you must save roughly $5,500 every month. Ouch. It makes sense, but you’d be surprised at how much more you’d need to save if you waited.

Likewise, the rate of return grows more significant the longer the investment time is. Look at the 10-year time frame; the difference between the required savings amounts at 2% and 8% (around 38% more) isn’t that great. The difference between the two equivalent values at 50 years is just over 670%.

Thus it’s best to start saving as soon as you can and try to acquire the highest return rate possible.

But let’s be realistic—few of us have the insight to begin saving when we are 15 or 20. We constantly believe that there will be time for it later since we have more pressing matters to attend to.

Instead, let’s imagine that you have a 30 year time frame. Long-term, it is reasonable to anticipate a return of 10.8%; this is the historical return of the stock market. As you can see, that would necessitate $373 in monthly savings. We have now entered a zone that may be extremely realistic for you.

A few things to remember are:

- Employer matching contributions should be used. The first place to look for assistance is here. Your 401(k) matching contributions are like a raise. You will receive money from your employer in addition to pre-tax payments from yourself.

- Utilize accounts that are tax-deferred. The figures above presuppose that you are exempt from paying taxes on your profits as they accrue. This necessitates a concentration on 401(k), IRA, and comparable accounts.

- Don’t touch the money! In 30 years at a 10.8% rate, every dollar you save is worth $25.16. Over time, every dollar you spend will cost you a lot. Hence, that $20 trinket you simply must have ends up costing you more than $503.20. Always invest in items that you either either need or genuinely adore.

- Have patience. Towards the end, your savings increase significantly more quickly than they did at the beginning.

For the majority of people, saving a million dollars is easily doable. The main problem is time. Over time, even someone with a smaller income can build up significant wealth. This indicates that now is the moment to start, not tomorrow or even next year.

You’ll be happy with the outcomes if you start saving right away. While a million dollars may not be as valuable as it once was, it’s still not bad.

by Andrea Carson | Mar 29, 2023 | SAVE MONEY

-

Start with the 52-Week Challenge.

A simple method to start saving more money is to take the 52-week savings challenge. Saving money is so simple that you’ll unlikely notice it.

Put $1 in a piggy bank or savings account to begin during the first week of January. Then, increase your savings each week based on the appropriate number for that week. For instance, you might set aside $2 for the second week of January, $3 for the third, and so on. By December, you will have saved $49, $50, $51, and $52 weekly. At year’s end, this will result in savings of $1,378.

-

Change Banks

Not every bank is made the same. Community banks and credit unions typically provide more excellent interest rates and benefits. Do your research and switch to a bank that offers benefits because of this. Discover bonuses like no ATM or maintenance costs, high interest on savings accounts, and no overdraft fees.

3. Automate Your Bills and Savings

Your employer’s human resources division can split your paychecks across your checking and savings accounts. Set up an automatic deposit of a certain proportion into your savings account to get started. Moreover, interest rates on savings accounts typically outpace those on checking accounts. You must take care of things independently if you work for yourself.

-

Use a budget tracking app to set goals

establishing an objective, such as “Pay off credit card debt” or “Student loans. Create a workable, realistic plan for accomplishing it, which will aid in your commitment to the goal.

-

Put Your Credit on Ice

Do you need help controlling your credit card usage? And I do mean that. You need your credit card at some point, so you don’t want to get rid of it. Try putting your credit card on hold. Please put it in a bag with water and freeze it. In this manner, your card will need to defrost before use. This should give you pause before making a rash decision to buy something.

-

Look for yourself

Get some exercise, eat well, and sleep well enough. Start giving up bad practices like smoking. Exercise caution, such as washing your hands after using the restroom and getting regular examinations. Make that dental appointment. You may avoid anything with these methods, from the flu to something more serious like a root canal. Even seemingly unimportant health issues might hurt your income. You don’t want to pay for many medicine and doctor co-pays.

-

Seek discounts or freebies

You may maintain your health or enhance your attractiveness for little or almost nothing. Free haircuts are available at the local beauty school. Take advantage of Living Social, Groupon, or Yipit fitness coupons. Join in on a free gym session.

8. Go Generic

To determine whether generic versions of prescription medications are a good choice, consult your doctor first. Generic drugs typically have a lower annual purchase cost than most brand-name medications by several hundred dollars. Find a doctor or insurer who will prescribe generic medications if your doctor or insurance provider won’t.

-

Get shorter and colder showers

It’s only sometimes enjoyable to shower quickly, especially when the weather is icy. Yet if you pay for it, it will lower your water and electric bills. The cause? Heating water and adding more to your tank both require energy.

More excellent showers can also improve your skin and hair and make you more awake. Your colder rain will boost weight loss, reduce stress, and ease depression while boosting immunity and circulation.

-

Create Your Cosmetics

Since you can make these critical beauty and grooming products with only seven components, why spend hundreds of dollars on them?

Some locally produced cosmetics seem too good to be true. Beeswax, liquid carrier oil, shea butter, coconut oil, and coconut butter are all excellent options. To make everything, combine arrowroot powder with mint and lavender essential oils. Deodorant, shaving soap, bug-off bars, sunscreen bars, and shampoo can all be made on a budget.

-

Evaluate Homeowners Insurance and Mortgage Refinancing

Make sure to compare insurance prices from different firms if you own a property. When renewing your current homeowner’s insurance coverage, consider the costs. You should use QuoteWizard to find the best insurance prices.

-

Make Your House Weatherproof

Your home’s cracks and holes should be caulked. These may be the energy hogs that homes consume the most. In the winter, cracks allow warm air to escape, while cold air can run in the summer. You may find all the necessary supplies to stop these air leaks at your neighborhood hardware shop.

Ensure your home is well-insulated and weatherproofed by switching out single-paneled windows for storm windows. Close these at night in the winter to keep drafts out and during the day in the summer to keep the sun out.

-

Reduce the use of heating and cooling

Installing a programmable thermostat like Nest can automate your home’s climate control. You’ll cut your yearly heating and cooling expenses by about $200.

Use strategies like layering blankets, sipping hot beverages in the winter, and applying ice on pulse points to reduce heating and cooling bills further.

-

Reduce the water heater’s temperature

Which low? The Department of Energy states that it should be around 120 degrees. You may cut your water heating expenditures by 3% to 5% for every 10oF drops in temperature.

-

Turn off your energy vampires

All of the following, if plugged in, use energy even when not in use. A printer, blender, microwave, toaster, computer, stereo, phone charger, and other non-essential items. Appliances are still using the wall for power. You might spend about one month’s electricity on this ‘vampire energy’ every year.

To swiftly turn off everything by pushing a single button, plug these devices onto a power strip.

-

Make a list and follow it.

Make a list before shopping so you won’t buy anything else, even for new seasonal clothing or your weekly dinners. Only make the purchases on your list to avoid overspending. This budgeting method might lead to annual savings of hundreds of dollars, if not thousands.

-

Don’t use coupons as an excuse to make purchases.

You can save money by using coupons in your weekly supermarket circular, on Living Social, or through an app like Checkout 51. But resist the urge to buy anything just because you have a coupon. Only buy something if you are sure that you will use it.

-

Grow Your Food, Eat Leftovers, and Pack Your Lunch

Brown-bagging your lunch can save you a ton of money over time and generally be a healthier choice. Consider it. You might only spend $5 daily on lunch instead of $10 per day.

Don’t just pack your lunch; keep the leftovers as well. So that you can enjoy them on nights when you don’t feel like cooking, freeze the leftovers. Get inventive and create another delectable dish with the pieces.

Instead of purchasing vegetables from the store, think about growing your own. Consider cultivating beans, mushrooms, oranges, tomatoes, avocados, and tomatoes. You can still grow many fruits and vegetables indoors if you need a backyard.

-

Get a Library Card and Participate

Libraries provide more than just printed literature. They also sell CDs, DVDs, and e-books. These locations offer tools and sewing machines for rent or loan.

Share materials with friends or family in addition to the library where you live. Just ask a friend or acquaintance to lend you a book, a Netflix subscription, a bike, or some power tools, for example.

-

Spend time with frugal friends

Go hog wild during dinner and hang out with individuals who don’t like to go out all the time. Spend more time with folks who want to go to bargain stores, play board games, and have potluck dinners—utilizing the many free events.

21. Walk and bike when practical.

Walking or riding a bike is beneficial to your health and saving money. The next time you have a little shopping trip, consider walking to the grocery store rather than driving.

-

Keep up with your vehicle

Correct maintenance is one of the most crucial elements of owning a cheap car. Maintaining adequate tire pressure, changing your oil regularly, and getting your engine tuned up as needed. You may save money on maintenance by eliminating “surprises,” keeping on gas, and increasing the lifespan of your car.

-

Carpool

Did you know that the typical American who commutes to and from work annually spends more than $1,000 on gas? You can save on maintenance and gas by sharing a vehicle with a coworker. As a result, you won’t need to worry about buying a new car any time soon.

25. Use public transportation when possible.

Tolls and parking fees can be avoided by taking public transit. Using the bus or metro instead of your automobile may save money and reduce your gas usage and the everyday wear and tear on your vehicle. Due to less frequent car use, your insurance rate may also be reduced.

26. Compare prices on everything.

Search around for the lowest-cost auto insurance. To locate the most affordable gas prices, use GasBuddy. Also, search on many websites for cheap flights when you travel.

Americans could be better at saving. According to the U.S. Bureau of Economic Analysis, personal savings in the country are a pitiful 3.8%. Thus, Americans save around $3.80 out of every $100 they earn after taxes for retirement, unexpected costs, and rainy-day funds. That could be better.

People can save money in various ways without increasing their income. While side jobs, rewards, credit cards, and loyalty programs can help consumers save money. We hope these 26 recommendations will enable you to increase your savings.

by Andrea Carson | Mar 22, 2023 | SAVE MONEY

Building up a healthy savings account is one of the finest methods to control your finances in today’s unstable economy. Nobody wants to experience the anxiety of being only one or two paychecks away from financial ruin due to a lack of reserves for when “something occurs.” Job loss, disability, car trouble, a sick child or pet, and other financial crises are specific instances. If you want to start small, this post will provide you with some saving tips:

-

Establish direct deposits into your savings account.

Setting up a monthly direct debit from your checking account to your savings account can allow you to save money over time without doing any extra work. This strategy can be beneficial when your savings accounts are set aside for specific objectives like creating an emergency fund, taking a vacation, or saving for a down payment on a house.

-

Total up your coins and tiny bills.

A more labor-intensive approach is to gather all the pennies and small bills you’ve collected throughout the day and place them in a savings envelope or jar. When you have a sizable sum, you can put it straight into your savings account and see your balance increase.

Using cash instead of credit cards when you want to monitor your spending makes sense because it might be more difficult to part with actual money. Although it takes time to accumulate funds, this method is suitable for steady savings development.

-

Be ready for your grocery store trips

You may save a lot of money on groceries by doing some preparation work before shopping.

Make a list of what you need and check your pantry before shopping to prevent impulsive purchases. Shop at supermarkets like Aldi and IGA that provide affordable prices.

Wherever feasible, choose locally farmed and seasonal produce. Flipping through the most recent fliers from your favorite grocer is simple; you could even find a coupon.

-

Reduce spending at restaurants and on takeout.

While eating out or ordering takeout is typically more expensive than cooking at home, cutting back on restaurant meals or food delivery is one of the easiest ways to increase your savings.

Aim to prepare breakfast and lunch at the very least if you frequently travel or eat out as part of your profession. You can choose starters or divide a main dish with your dining partner to cut dining costs. Also, skipping dessert and drinks can help you stretch your money.

-

Get entertainment discounts

Check your local calendar before splashing on expensive tickets to exclusive events; your neighborhood may offer free concerts and other live or recorded activities. To cut expenditures on entertainment, take advantage of free days at museums and national parks. Moreover, inquire about special savings for seniors, students, members of the military, and more.

-

Make substantial purchasing plans

You may save money by planning your purchases of gadgets, cars, appliances, furniture, and more around annual sale events like the end of the fiscal year or Boxing Day. Monitoring price changes over time makes it worthwhile to verify that a deal is indeed a deal.

-

Limit online purchases

To stop spending money on items you might not need, you might make it more difficult to purchase online. Choose to manually enter your shipping address and credit card number each time you place an order rather than keeping your billing information. Due to the added work, you’ll probably make fewer impulse purchases.

-

Postpone purchases according to the 30-day rule.

Giving yourself time to think before making a purchase is one way to stop yourself from going overboard.

If you’re shopping online, think about adding the item to your cart and leaving the page until you’ve had more time to examine it. (In rare circumstances, the shop may even give you a coupon code after discovering you abandoned the cart.) If 30 days seem excessively long, you might want to try shorter intervals, such as a 24- or 48-hour hold.

-

Be inventive with your gifts

With inexpensive gift suggestions like herb gardens and books, you may save money or do it yourself. Making a costly item doesn’t always show how much you care; sometimes, making cookies, creating art, or cooking for someone else does. Offering to accompany someone to a nearby (free) museum or another event is another way to give the gift of your time.

-

Reduce your auto expenses

Refinancing your auto loan and taking advantage of lower interest rates could result in significant savings throughout your term. You can save on continuing car maintenance expenditures by driving less, removing heavy objects from your boot, and avoiding needless quick acceleration. Regular comparison shopping for auto insurance can also help you save money compared to letting your current policy automatically renew.

-

Lessen your use of gasoline

In addition to using public transportation when possible, there are other things you can do to reduce your gas consumption and save money since you have no influence over gas prices at the pump. To check fuel costs and find the lowest fuel available, try utilizing a mobile app like Fuel Map or Petrol Spy.

-

Combine the internet with paid TV.

Consider combining many services under one plan to reduce your internet, pay TV, or streaming bill. For instance, Foxtel’s Broadband + Platinum Plus bundle offers a Foxtel subscription and high-speed internet.

Cutting ties with subscription TV and sticking with cheaper streaming services like Netflix and Stan is an additional choice. It’s worthwhile to consider how frequently you watch each service or downgrade to versions with advertisements if you want to minimize expenditures further.

-

Change your mobile plan

Changing your plan is one method to save money on your mobile phone bill, but it’s not the only way.

-

Lower your monthly electric bill

You can save hundreds a year on your electric bill by making significant and tiny changes to your energy use. Consider adopting intelligent power strips, replacing older appliances with more energy-efficient models, switching to a smart thermostat, and fixing any insulation gaps in your home. Over time, even small reductions in your monthly electricity usage can result in significant savings.

-

Terminate any unused subscriptions

Refinancing could save you several hundred dollars a month if you can get a lower interest rate on your house loan. While some upfront costs are associated with refinancing, they can be recovered over time if you start making lower monthly payments.

-

Set financial targets

Establish a precise but doable objective. The goal can be to “pay off my credit card debt quicker” or “contribute $5,000 to my super fund account this year.” Calculate how much you need to save monthly or yearly to achieve your goal.

-

Track expenditures

Consider using a budget trackings tool like MoneyBrilliant, GoodBudget, or Frollo. Observe the difference between your monthly revenue and expenses or your cash flow. Furthermore, this step will simplify tracking advancement toward your savings objective.

-

Repay debt with a high-interest rate

Debt payments can put a tremendous strain on your overall spending plan. The general interest paid will be reduced if you can pay off high-interest debt more rapidly by making extra payments utilizing the snowball or avalanche methods. You will also be relieved of that load sooner. Start saving the money instead after that.

-

Save money in a high-yield savings account

Invest your growing earnings in a high-yield online savings account to get the most out of your money while you work toward your financial objectives. Interest rates at some of the top neobanks and digital banks can be greater than those at traditional central banks.

-

Following a budget, which entails establishing goals for your spending, is one wise method to manage your money and ideally retain more of it.

The future is incredibly unpredictable, making it challenging to foresee the circumstances we may encounter in the days and years to come. Because of this, it becomes crucial and vitally necessary to invest and save money intelligently and sensibly.

by Andrea Carson | Mar 15, 2023 | Make Money

-

Find freelance work.

Working for yourself and completing jobs under contract is known as freelance work. You are still self-employed when you work as a freelancer, even if you sign a contract to work for an organization. Also, there are many internet freelance employment. In reality, several websites are post-employment for freelancers.

Check out Upwork, without a doubt. They are the most prominent freelance marketplace in the world. A lot of remote freelancing jobs are available on Upwork. You’ll find listings for independent contractors specializing in writing, project management, graphic design, and other fields. Upwork, oin, is where over 15 million independent contractors find employment. Moreover, Upwork has nearly 2 million freelancing tasks posted.

Even as a freelancer, time is always money. Check out SolidGigs if you require work quickly. The opportunities are vetted for you by them as they quickly sort through all the jobs and send you the top ones. You won’t waste time browsing through many available tasks using SolidGigs.

-

Start a blog.

Because they’re simple to start and provide various monetization options, blogs are a well-liked tool for making money online. If your blog focuses on that subject, you might also sell visitors to your site digital goods relating to that topic, such as tutorials, templates, ebooks, and more.

3. Create an app

You may assist a brand to appear directly on the home screen of the mobile devices used by its audience by creating an app. They can benefit from gamification, active communities, and engaging content in this way. As there is a high need for app developers, creating your app or working for a business that needs one might be a great way to supplement your income.

4. Become an online teacher

There is always a need for tutors. You can assist students in raising their grades and getting ready for tests, whether you’re a teacher or someone with specialized knowledge. Remember that you should have teaching experience and a certification in the relevant field. Having credibility will benefit both parents and pupils.

- Become a spokesperson

Start considering your possible niche if it appeals to you. Influencers use social media or YouTube for advertising or suggesting goods to influence potential customers to buy them. You can have a passion for travel or fashion. Perhaps you have a lot to say about technology or athletic equipment. Choose a specialization that enables you to highlight your strengths after considering your strong points.

-

Construct webpages

Every company today requires a website. Today, you can create a website without knowing how to code, and there is a tremendous market for web designers.

You can quickly create a website that appears slick and professional by using Mailchimp. If you’re making a website from scratch, you can get a domain through Mailchimp that corresponds with a specific subject or company.

-

Start investing

Don’t overlook the traditional stock market, even though you can look at other investment ideas like real estate and cryptocurrencies. Many people believe they cannot invest in the stock market because they lack the necessary funds.

The good news is that there usually isn’t a minimum amount required to start trading stocks. There are many brokerage platforms out there, so you may want to look at a successful youtube channel that will explain the distinctions between them. You can then choose the solution that best suits your requirements.

-

Market your photographs and artwork

Selling your works of art and photographs is another choice. If you enjoy being creative, you might want to think about selling your results online to start earning money.

For example, if you love capturing images of animals, you might be able to sell them online. Or, if you’re good at photographing people, you might wish to work as a photographer.

You should strive to use various social media marketing techniques that might aid in spreading the word about you. In this approach, more people will become aware of your photography and artistic endeavors and become interested in your products and services.

Remember that art can take many different forms. You may be an expert with a paintbrush or an expert with a computer. Given how popular it has become in recent years, you might wish to use your computer talents to create digital artwork for others.

-

Work as a translator online

Do you know another language? If so, you might be shocked by how much someone might be willing to pay for your services. The translation is another option to earn money online.

The world we live in today is more interconnected than ever. You will instantly become more marketable almost anywhere if you speak a second language. You can work on several kinds of translation jobs.

For instance, you might want to participate in a conversation as a remote translator. A doctor might use a translator to help facilitate the discussion if they are having trouble explaining something to a patient.

-

Complete online polls

There are several chances for surveys available. Consider carefully which opportunity may best suit your needs. For instance, some internet surveys favor a particular topic. Some surveys require you to watch a video first, then ask questions about what you just watched. Do not forget that different surveys use various forms of compensation. You can be eligible for a bonus just for joining some survey programs. With some survey programs, you can deposit money into an online account. Also, some surveys will award you loyalty points you can exchange for a gift card to your preferred restaurant or retailer.

Remember that not every survey you see will necessarily be open to you. Consider which survey programs suit your background the best. You can optimize your earnings from each study in this way.

-

Offer your used clothing

You might be interested in opening your own online store or e-commerce venture. There are several choices, so consider selling your used clothing to earn money online.

Numerous retailers would be happy to list your clothing in exchange for a nominal price. Typically, a portion of each sale is taken by these online services. Consider this while determining how much to charge for your clothing.

There’s a strong probability that your closet has the clothing you haven’t worn in over a year if you look through it. You could wish to remove every item of clothing from your wardrobe and organize it into separate piles.

-

Make a podcast

Finally, you might want to consider starting a podcast to earn money online. More people are listening to podcasts now than ever before. Due to their accessibility from almost everywhere, podcasts have become popular among many.

Because they may listen to a podcast instead of radio advertisements, some individuals prefer to listen to them while driving. Some enjoy listening to podcasts while making laundry or cooking dinner.