by Andrea Carson | Mar 29, 2023 | SAVE MONEY

Although a million dollars isn’t what it once was, it would be a significant improvement for most of us. Additionally, if you can save a million dollars, you can keep two or three million. Are you able to make such savings?

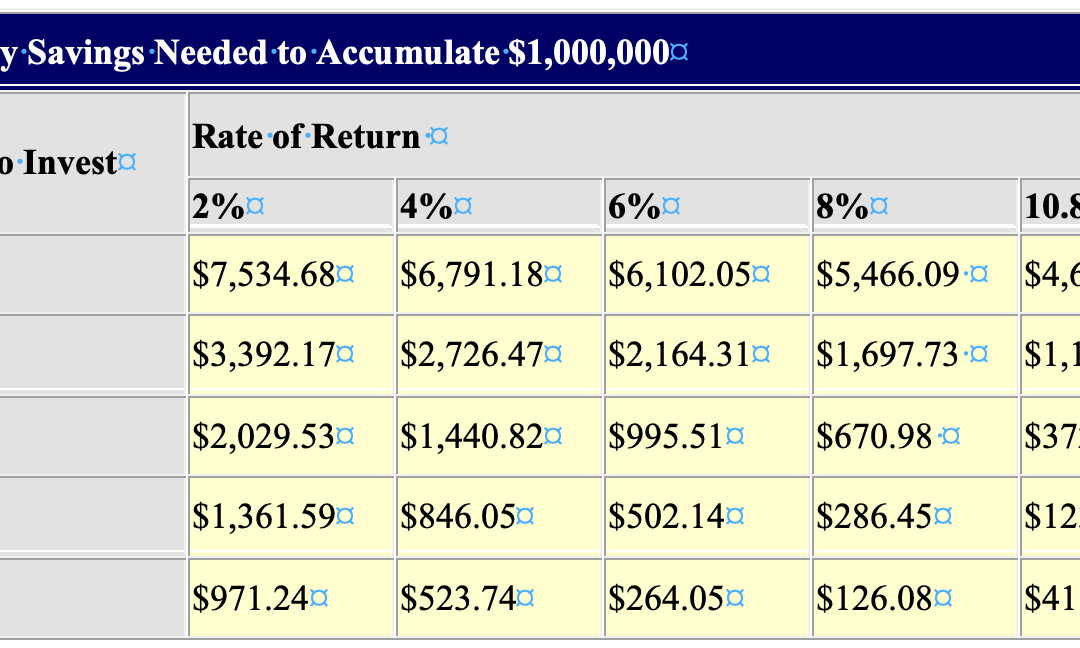

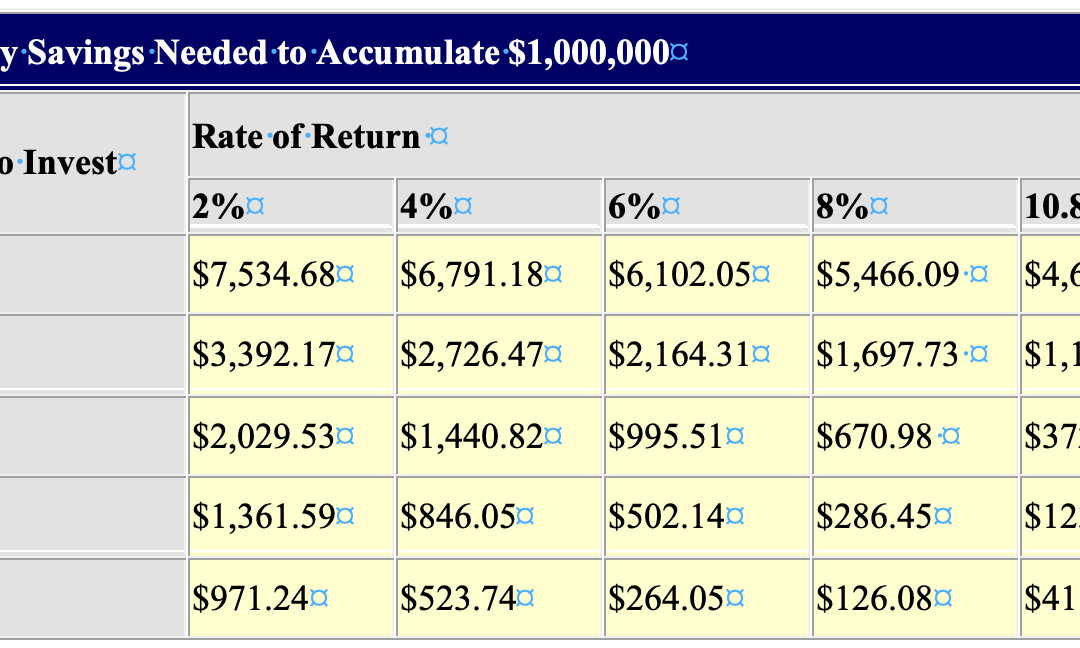

Everything is conceivable. Time is of the essence when it comes to saving a specific quantity of money. Let’s look at a table to determine how much money would need to be set aside each month to save $1,000,000:

As you can see, you need to save less money each month the earlier you start. To save a million dollars in 50 years, you just need to save $126.08 every month at an 8% return. But to achieve the same goal in 10 years, you must save roughly $5,500 every month. Ouch. It makes sense, but you’d be surprised at how much more you’d need to save if you waited.

Likewise, the rate of return grows more significant the longer the investment time is. Look at the 10-year time frame; the difference between the required savings amounts at 2% and 8% (around 38% more) isn’t that great. The difference between the two equivalent values at 50 years is just over 670%.

Thus it’s best to start saving as soon as you can and try to acquire the highest return rate possible.

But let’s be realistic—few of us have the insight to begin saving when we are 15 or 20. We constantly believe that there will be time for it later since we have more pressing matters to attend to.

Instead, let’s imagine that you have a 30 year time frame. Long-term, it is reasonable to anticipate a return of 10.8%; this is the historical return of the stock market. As you can see, that would necessitate $373 in monthly savings. We have now entered a zone that may be extremely realistic for you.

A few things to remember are:

- Employer matching contributions should be used. The first place to look for assistance is here. Your 401(k) matching contributions are like a raise. You will receive money from your employer in addition to pre-tax payments from yourself.

- Utilize accounts that are tax-deferred. The figures above presuppose that you are exempt from paying taxes on your profits as they accrue. This necessitates a concentration on 401(k), IRA, and comparable accounts.

- Don’t touch the money! In 30 years at a 10.8% rate, every dollar you save is worth $25.16. Over time, every dollar you spend will cost you a lot. Hence, that $20 trinket you simply must have ends up costing you more than $503.20. Always invest in items that you either either need or genuinely adore.

- Have patience. Towards the end, your savings increase significantly more quickly than they did at the beginning.

For the majority of people, saving a million dollars is easily doable. The main problem is time. Over time, even someone with a smaller income can build up significant wealth. This indicates that now is the moment to start, not tomorrow or even next year.

You’ll be happy with the outcomes if you start saving right away. While a million dollars may not be as valuable as it once was, it’s still not bad.

by Andrea Carson | Mar 29, 2023 | SAVE MONEY

-

Start with the 52-Week Challenge.

A simple method to start saving more money is to take the 52-week savings challenge. Saving money is so simple that you’ll unlikely notice it.

Put $1 in a piggy bank or savings account to begin during the first week of January. Then, increase your savings each week based on the appropriate number for that week. For instance, you might set aside $2 for the second week of January, $3 for the third, and so on. By December, you will have saved $49, $50, $51, and $52 weekly. At year’s end, this will result in savings of $1,378.

-

Change Banks

Not every bank is made the same. Community banks and credit unions typically provide more excellent interest rates and benefits. Do your research and switch to a bank that offers benefits because of this. Discover bonuses like no ATM or maintenance costs, high interest on savings accounts, and no overdraft fees.

3. Automate Your Bills and Savings

Your employer’s human resources division can split your paychecks across your checking and savings accounts. Set up an automatic deposit of a certain proportion into your savings account to get started. Moreover, interest rates on savings accounts typically outpace those on checking accounts. You must take care of things independently if you work for yourself.

-

Use a budget tracking app to set goals

establishing an objective, such as “Pay off credit card debt” or “Student loans. Create a workable, realistic plan for accomplishing it, which will aid in your commitment to the goal.

-

Put Your Credit on Ice

Do you need help controlling your credit card usage? And I do mean that. You need your credit card at some point, so you don’t want to get rid of it. Try putting your credit card on hold. Please put it in a bag with water and freeze it. In this manner, your card will need to defrost before use. This should give you pause before making a rash decision to buy something.

-

Look for yourself

Get some exercise, eat well, and sleep well enough. Start giving up bad practices like smoking. Exercise caution, such as washing your hands after using the restroom and getting regular examinations. Make that dental appointment. You may avoid anything with these methods, from the flu to something more serious like a root canal. Even seemingly unimportant health issues might hurt your income. You don’t want to pay for many medicine and doctor co-pays.

-

Seek discounts or freebies

You may maintain your health or enhance your attractiveness for little or almost nothing. Free haircuts are available at the local beauty school. Take advantage of Living Social, Groupon, or Yipit fitness coupons. Join in on a free gym session.

8. Go Generic

To determine whether generic versions of prescription medications are a good choice, consult your doctor first. Generic drugs typically have a lower annual purchase cost than most brand-name medications by several hundred dollars. Find a doctor or insurer who will prescribe generic medications if your doctor or insurance provider won’t.

-

Get shorter and colder showers

It’s only sometimes enjoyable to shower quickly, especially when the weather is icy. Yet if you pay for it, it will lower your water and electric bills. The cause? Heating water and adding more to your tank both require energy.

More excellent showers can also improve your skin and hair and make you more awake. Your colder rain will boost weight loss, reduce stress, and ease depression while boosting immunity and circulation.

-

Create Your Cosmetics

Since you can make these critical beauty and grooming products with only seven components, why spend hundreds of dollars on them?

Some locally produced cosmetics seem too good to be true. Beeswax, liquid carrier oil, shea butter, coconut oil, and coconut butter are all excellent options. To make everything, combine arrowroot powder with mint and lavender essential oils. Deodorant, shaving soap, bug-off bars, sunscreen bars, and shampoo can all be made on a budget.

-

Evaluate Homeowners Insurance and Mortgage Refinancing

Make sure to compare insurance prices from different firms if you own a property. When renewing your current homeowner’s insurance coverage, consider the costs. You should use QuoteWizard to find the best insurance prices.

-

Make Your House Weatherproof

Your home’s cracks and holes should be caulked. These may be the energy hogs that homes consume the most. In the winter, cracks allow warm air to escape, while cold air can run in the summer. You may find all the necessary supplies to stop these air leaks at your neighborhood hardware shop.

Ensure your home is well-insulated and weatherproofed by switching out single-paneled windows for storm windows. Close these at night in the winter to keep drafts out and during the day in the summer to keep the sun out.

-

Reduce the use of heating and cooling

Installing a programmable thermostat like Nest can automate your home’s climate control. You’ll cut your yearly heating and cooling expenses by about $200.

Use strategies like layering blankets, sipping hot beverages in the winter, and applying ice on pulse points to reduce heating and cooling bills further.

-

Reduce the water heater’s temperature

Which low? The Department of Energy states that it should be around 120 degrees. You may cut your water heating expenditures by 3% to 5% for every 10oF drops in temperature.

-

Turn off your energy vampires

All of the following, if plugged in, use energy even when not in use. A printer, blender, microwave, toaster, computer, stereo, phone charger, and other non-essential items. Appliances are still using the wall for power. You might spend about one month’s electricity on this ‘vampire energy’ every year.

To swiftly turn off everything by pushing a single button, plug these devices onto a power strip.

-

Make a list and follow it.

Make a list before shopping so you won’t buy anything else, even for new seasonal clothing or your weekly dinners. Only make the purchases on your list to avoid overspending. This budgeting method might lead to annual savings of hundreds of dollars, if not thousands.

-

Don’t use coupons as an excuse to make purchases.

You can save money by using coupons in your weekly supermarket circular, on Living Social, or through an app like Checkout 51. But resist the urge to buy anything just because you have a coupon. Only buy something if you are sure that you will use it.

-

Grow Your Food, Eat Leftovers, and Pack Your Lunch

Brown-bagging your lunch can save you a ton of money over time and generally be a healthier choice. Consider it. You might only spend $5 daily on lunch instead of $10 per day.

Don’t just pack your lunch; keep the leftovers as well. So that you can enjoy them on nights when you don’t feel like cooking, freeze the leftovers. Get inventive and create another delectable dish with the pieces.

Instead of purchasing vegetables from the store, think about growing your own. Consider cultivating beans, mushrooms, oranges, tomatoes, avocados, and tomatoes. You can still grow many fruits and vegetables indoors if you need a backyard.

-

Get a Library Card and Participate

Libraries provide more than just printed literature. They also sell CDs, DVDs, and e-books. These locations offer tools and sewing machines for rent or loan.

Share materials with friends or family in addition to the library where you live. Just ask a friend or acquaintance to lend you a book, a Netflix subscription, a bike, or some power tools, for example.

-

Spend time with frugal friends

Go hog wild during dinner and hang out with individuals who don’t like to go out all the time. Spend more time with folks who want to go to bargain stores, play board games, and have potluck dinners—utilizing the many free events.

21. Walk and bike when practical.

Walking or riding a bike is beneficial to your health and saving money. The next time you have a little shopping trip, consider walking to the grocery store rather than driving.

-

Keep up with your vehicle

Correct maintenance is one of the most crucial elements of owning a cheap car. Maintaining adequate tire pressure, changing your oil regularly, and getting your engine tuned up as needed. You may save money on maintenance by eliminating “surprises,” keeping on gas, and increasing the lifespan of your car.

-

Carpool

Did you know that the typical American who commutes to and from work annually spends more than $1,000 on gas? You can save on maintenance and gas by sharing a vehicle with a coworker. As a result, you won’t need to worry about buying a new car any time soon.

25. Use public transportation when possible.

Tolls and parking fees can be avoided by taking public transit. Using the bus or metro instead of your automobile may save money and reduce your gas usage and the everyday wear and tear on your vehicle. Due to less frequent car use, your insurance rate may also be reduced.

26. Compare prices on everything.

Search around for the lowest-cost auto insurance. To locate the most affordable gas prices, use GasBuddy. Also, search on many websites for cheap flights when you travel.

Americans could be better at saving. According to the U.S. Bureau of Economic Analysis, personal savings in the country are a pitiful 3.8%. Thus, Americans save around $3.80 out of every $100 they earn after taxes for retirement, unexpected costs, and rainy-day funds. That could be better.

People can save money in various ways without increasing their income. While side jobs, rewards, credit cards, and loyalty programs can help consumers save money. We hope these 26 recommendations will enable you to increase your savings.

by Andrea Carson | Mar 22, 2023 | SAVE MONEY

Building up a healthy savings account is one of the finest methods to control your finances in today’s unstable economy. Nobody wants to experience the anxiety of being only one or two paychecks away from financial ruin due to a lack of reserves for when “something occurs.” Job loss, disability, car trouble, a sick child or pet, and other financial crises are specific instances. If you want to start small, this post will provide you with some saving tips:

-

Establish direct deposits into your savings account.

Setting up a monthly direct debit from your checking account to your savings account can allow you to save money over time without doing any extra work. This strategy can be beneficial when your savings accounts are set aside for specific objectives like creating an emergency fund, taking a vacation, or saving for a down payment on a house.

-

Total up your coins and tiny bills.

A more labor-intensive approach is to gather all the pennies and small bills you’ve collected throughout the day and place them in a savings envelope or jar. When you have a sizable sum, you can put it straight into your savings account and see your balance increase.

Using cash instead of credit cards when you want to monitor your spending makes sense because it might be more difficult to part with actual money. Although it takes time to accumulate funds, this method is suitable for steady savings development.

-

Be ready for your grocery store trips

You may save a lot of money on groceries by doing some preparation work before shopping.

Make a list of what you need and check your pantry before shopping to prevent impulsive purchases. Shop at supermarkets like Aldi and IGA that provide affordable prices.

Wherever feasible, choose locally farmed and seasonal produce. Flipping through the most recent fliers from your favorite grocer is simple; you could even find a coupon.

-

Reduce spending at restaurants and on takeout.

While eating out or ordering takeout is typically more expensive than cooking at home, cutting back on restaurant meals or food delivery is one of the easiest ways to increase your savings.

Aim to prepare breakfast and lunch at the very least if you frequently travel or eat out as part of your profession. You can choose starters or divide a main dish with your dining partner to cut dining costs. Also, skipping dessert and drinks can help you stretch your money.

-

Get entertainment discounts

Check your local calendar before splashing on expensive tickets to exclusive events; your neighborhood may offer free concerts and other live or recorded activities. To cut expenditures on entertainment, take advantage of free days at museums and national parks. Moreover, inquire about special savings for seniors, students, members of the military, and more.

-

Make substantial purchasing plans

You may save money by planning your purchases of gadgets, cars, appliances, furniture, and more around annual sale events like the end of the fiscal year or Boxing Day. Monitoring price changes over time makes it worthwhile to verify that a deal is indeed a deal.

-

Limit online purchases

To stop spending money on items you might not need, you might make it more difficult to purchase online. Choose to manually enter your shipping address and credit card number each time you place an order rather than keeping your billing information. Due to the added work, you’ll probably make fewer impulse purchases.

-

Postpone purchases according to the 30-day rule.

Giving yourself time to think before making a purchase is one way to stop yourself from going overboard.

If you’re shopping online, think about adding the item to your cart and leaving the page until you’ve had more time to examine it. (In rare circumstances, the shop may even give you a coupon code after discovering you abandoned the cart.) If 30 days seem excessively long, you might want to try shorter intervals, such as a 24- or 48-hour hold.

-

Be inventive with your gifts

With inexpensive gift suggestions like herb gardens and books, you may save money or do it yourself. Making a costly item doesn’t always show how much you care; sometimes, making cookies, creating art, or cooking for someone else does. Offering to accompany someone to a nearby (free) museum or another event is another way to give the gift of your time.

-

Reduce your auto expenses

Refinancing your auto loan and taking advantage of lower interest rates could result in significant savings throughout your term. You can save on continuing car maintenance expenditures by driving less, removing heavy objects from your boot, and avoiding needless quick acceleration. Regular comparison shopping for auto insurance can also help you save money compared to letting your current policy automatically renew.

-

Lessen your use of gasoline

In addition to using public transportation when possible, there are other things you can do to reduce your gas consumption and save money since you have no influence over gas prices at the pump. To check fuel costs and find the lowest fuel available, try utilizing a mobile app like Fuel Map or Petrol Spy.

-

Combine the internet with paid TV.

Consider combining many services under one plan to reduce your internet, pay TV, or streaming bill. For instance, Foxtel’s Broadband + Platinum Plus bundle offers a Foxtel subscription and high-speed internet.

Cutting ties with subscription TV and sticking with cheaper streaming services like Netflix and Stan is an additional choice. It’s worthwhile to consider how frequently you watch each service or downgrade to versions with advertisements if you want to minimize expenditures further.

-

Change your mobile plan

Changing your plan is one method to save money on your mobile phone bill, but it’s not the only way.

-

Lower your monthly electric bill

You can save hundreds a year on your electric bill by making significant and tiny changes to your energy use. Consider adopting intelligent power strips, replacing older appliances with more energy-efficient models, switching to a smart thermostat, and fixing any insulation gaps in your home. Over time, even small reductions in your monthly electricity usage can result in significant savings.

-

Terminate any unused subscriptions

Refinancing could save you several hundred dollars a month if you can get a lower interest rate on your house loan. While some upfront costs are associated with refinancing, they can be recovered over time if you start making lower monthly payments.

-

Set financial targets

Establish a precise but doable objective. The goal can be to “pay off my credit card debt quicker” or “contribute $5,000 to my super fund account this year.” Calculate how much you need to save monthly or yearly to achieve your goal.

-

Track expenditures

Consider using a budget trackings tool like MoneyBrilliant, GoodBudget, or Frollo. Observe the difference between your monthly revenue and expenses or your cash flow. Furthermore, this step will simplify tracking advancement toward your savings objective.

-

Repay debt with a high-interest rate

Debt payments can put a tremendous strain on your overall spending plan. The general interest paid will be reduced if you can pay off high-interest debt more rapidly by making extra payments utilizing the snowball or avalanche methods. You will also be relieved of that load sooner. Start saving the money instead after that.

-

Save money in a high-yield savings account

Invest your growing earnings in a high-yield online savings account to get the most out of your money while you work toward your financial objectives. Interest rates at some of the top neobanks and digital banks can be greater than those at traditional central banks.

-

Following a budget, which entails establishing goals for your spending, is one wise method to manage your money and ideally retain more of it.

The future is incredibly unpredictable, making it challenging to foresee the circumstances we may encounter in the days and years to come. Because of this, it becomes crucial and vitally necessary to invest and save money intelligently and sensibly.

by Andrea Carson | Feb 22, 2023 | SAVE MONEY

Overdraft fees can be real killers. To add insult to injury, you’re charged a considerable amount of money as a penalty. You likely already have some financial challenges to get into that situation in the first place.

Banks are growing more reliant on these fees. These fees account for over $32 billion in bank income each year.

Banks have software that maximizes your overdraft charges. Imagine having $100 in the bank and two outstanding checks for $200 and $50. If both are payable around the same time, the software will ensure that the $200 check gets paid first. That way, you’re overdrawn twice.

While many banks offer overdraft protection, this is rarely the answer. Those that overdraft frequently would save money by paying the overdraft fees rather than opting for overdraft protection.

Try these strategies to eliminate or reduce your overdraft charges:

- Use a credit card instead of a debit card or check. This method is not without risk. It requires you to keep track of your spending and be disciplined to avoid overspending. This method can be dangerous if you’re unwilling or unable to control your spending.

- With this method, you only need to write one check each month. That makes it challenging to be overdrawn.

- You can enter your credit card purchases into your checkbook as if you had written a check. This will help to control your spending.

- Keep some extra money in your checking account. This is similar to stashing an additional $20 in your car for emergencies. Many people avoid overdraft problems by keeping extra money in their checking accounts. This can also help to stay above the minimum balance required to avoid unnecessary fees.

- Use online banking systems to stay on top of your balance. Most banks today offer many alerts to keep you updated with your account balance information. You can check your pending payments at the end of each day and make the necessary corrections.

- Many accounts will allow you to set up low-balance alerts.

- It’s challenging to be overdrawn if you never use a check or debit card. You can only be stretched by withdrawing a little cash. The bank won’t let you have it.

- Use cash for your day-to-day expenses. You can pay your bills with online banking, but a better alternative might be to pay your bills with money orders. Your bank can provide you with a money order, but so can your local post office. These typically aren’t free, but it’s a sure way to avoid being overdrawn on your account again.

Overdraft fees can create a tremendous financial challenge if you’re already struggling. Those with at least one overdraft pay an average of over $250 in overdraft fees each year. You can find something better to do with that money than give it to your bank!

Responsible banking is simple, yet many people need help managing it responsibly and effectively. Always know how much is in your account and track your spending. You may need to review your balance and spending daily. Develop a plan that works for you. Follow one of these strategies or come up with your own.

by Andrea Carson | Feb 15, 2023 | SAVE MONEY

If you must learn to reduce your everyday spending, saving money can be very challenging. You’ll be shocked to see how much money you may save once you’ve decided to make daily budget cuts!

The following advice will make it simple for you to go closer to your financial objectives:

- Monitor your spending. Using a little notebook that you can carry around in your pocket or purse is one of the simplest methods to keep track of your spending.

- Record the amount you spend each time you purchase your notepad. The majority of people make the error of omitting this crucial step.

- Never undervalue the importance of keeping track of your finances. Despite the incredible strength of your memory, it can be challenging to recall where all that money went.

- It could take some time to get in the habit of keeping track of how much money you spend each day, but once you do, it starts to come quite naturally.

- Reduce your indulgences. Your financial condition can significantly improve by cutting back on pleasure. Sadly, it must be more complex to splurge on entertainment and leisure. What, though, maybe crossed off your list?

- Rather than going to the theater, watch movies at home. Bring your friends for a potluck, and you may have dinner and a movie for less than the cost of movie tickets.

- Take into account quitting bad habits like smoking. You might try switching to an affordable substitute, like electronic cigarettes, or just concentrate on quitting smoking entirely. A pack of smokes might cost $10 or more in some places.

- Dine at home more often. We all enjoy dressing up and visiting a pricey restaurant for a relaxing evening with delicious food. There is nothing improper about that. Nonetheless, the bills might stack up to an absurd sum and significantly affect your finances.

- Take into account limiting how frequently you dine out.

- Start cooking at home. It’s more affordable, healthier, and enjoyable.

- Look into less-priced options for the services you already use. Every day, each of us uses a diverse collection of services. Would you do it if there was a method to lower those bills?

- Take into account prepaid phone cards. Most people spend much time on their smartphones, but how much time is spent making calls?

- Relying solely on text messages sent via the internet is another economical method of connecting with others.

- Is there a less-priced plan offered by your cable provider to suit your needs?

- Having your favorite magazines delivered right to your door is convenient. You may sign up for free online subscriptions to most of these magazines! But is there a less expensive option?

It takes some time to develop the habit of lowering expenses. But as soon as you train your mind to seek opportunities to save a little extra cash, you’ll see that your financial objectives are within your grasp!

by Andrea Carson | Feb 15, 2023 | SAVE MONEY

For businesses, the time value of money is a crucial financial factor. Inflation, risk concerns, prospective investment returns, and loan interest influence business decisions. In essence, you contrast the worth of the money you have right now with the relative importance of the money you will receive or spend in the future.

The following are the steps you should take if you want to save time and money at the same time:

Lead By Example

A potent instrument is a social influence. Setting an example for your company’s other employees is one of the finest methods to help it save money. If you’re careless with money, your coworkers probably won’t be either.

For many businesses, meetings are a productivity and financial drain. Harvard Business Review notes that problems arise when meetings are planned and conducted without considering how they may affect group and solitary work time, problems occur. By default, groups frequently wind up compromising either their own needs or those of others.

When meetings are appropriately conducted, projects advance and your business expand. But when done incorrectly, meetings become a pain for your company. A technique Amazon uses to make sessions short and fruitful is to reduce the number of attendees. They operate under the maxim that only a few people are present if it takes more than two pizzas to feed everyone.

Ditch conventional marketing methods

Running advertisements on TV and in print is expensive. Instead, use inexpensive marketing strategies. Innovative digital marketing techniques are also affordable and have high potential rewards. For instance, six hours a week is all it takes to do efficient social media marketing, and setting up a Facebook and Twitter account is free

Take into Account Working from Home

The advantages of remote labor are numerous. First, people are increasingly choosing remote work because it offers a better work-life balance. Also, the company has financial benefits, such as a more adaptable workforce and lower office space expenditures.

Improve the Comprehension of Your Audience.

You will only save money on all levels of your business if you know who your customers are and what they want. You’ll produce inferior goods and waste money marketing to the incorrect demographic. Instead, identify your “buyer-personas” and then incorporate them into your business plan to give them something of value.

Purchase Goods in Bulk

You usually purchase anything in bulk, which results in lower prices. Buy in bulk to save money unless you are a new business worrying about short-term cash flow. It would be best to buy anything you frequently use in size to save money for your business. Think about smaller expenditures like stationery up to larger ones like software and corporate laptops.

Shop Around for the most excellent price.

It’s frequently a good idea to haggle for a lower price. This could apply to software services, catering services, or your internet service provider.

Of course, bargaining is an art in and of itself. Think about the goods and services your company utilizes and how you might effectively haggle with suppliers to get a better deal (while retaining a good relationship with them.) If you’ve never done anything before, start gently and take advice from the experts.

Cease Paying Underperforming Workers.

A worker must be efficient in their position. If not, think about either of the following options: End their contract or put more effort into assisting them in improving their performance. Overly sentimental behavior will only benefit your company and positively impact other staff members’ morale.

Have Perks Instead of benefits

Instead of offering employee benefits, perks may be more cost-efficient and valuable. This is because, when appropriately used, bonuses can be viewed as having a higher value than comparable benefits. The utility and perceived thoughtfulness are frequently where the value lies.

Free munchies or Spotify subscriptions are two instances of this. They might only incur a tiny expense for the company, but they give employees a greater appreciation than a pay increase would.