by Andrea Carson | Jul 5, 2023 | Make Money, SAVE MONEY

Title: Mastering Your Money Matters: A Comprehensive Guide to Financial Success

Introduction

In our fast-paced and ever-changing world, money plays a crucial role in shaping our lives. Whether we like it or not, financial matters are an essential aspect of daily living. From managing expenses to planning for the future, understanding how money works and adopting sound financial practices are key to achieving long-term success and financial security. In this blog, we will explore various aspects of money matters and offer valuable insights to help you take control of your finances and build a solid financial foundation.

1. Understanding Financial Literacy

Financial literacy is the cornerstone of making informed financial decisions. It refers to the ability to comprehend and utilize financial skills effectively. Unfortunately, financial literacy remains an overlooked area in education, leaving many individuals ill-equipped to handle money matters. To improve financial literacy, we must start with the basics, such as budgeting, saving, investing, and debt management.

2. Budgeting: The Foundation of Financial Success

Budgeting is the process of creating a detailed plan for how to allocate your income. A well-structured budget enables you to control spending, save for future goals, and tackle debts. Start by assessing your income and expenses, setting financial goals, and prioritizing essential expenses. Budgeting can help you avoid living paycheck to paycheck and foster a healthier relationship with money.

3. The Power of Saving

Saving money is a crucial habit that can provide a safety net during unforeseen emergencies and pave the way for future financial growth. Implementing a disciplined saving strategy, such as the 50/30/20 rule (50% for necessities, 30% for wants, and 20% for savings), can help you strike a balance between meeting immediate needs and building a nest egg for the future.

4. Debt Management

Debt can become a significant burden, hampering your ability to achieve financial freedom. It is essential to differentiate between “good debt” (investments that can potentially appreciate in value) and “bad debt” (high-interest loans for non-essential items). Prioritize paying off high-interest debts first, and consider consolidating debts if it results in a more manageable repayment plan.

5. Investing Wisely

Investing is an essential component of wealth-building and beating inflation over time. However, it involves risk, and therefore, careful consideration is necessary before committing funds. Diversifying your investments across different asset classes, such as stocks, bonds, real estate, and mutual funds, can help mitigate risk and potentially enhance returns. If you are uncertain about investing, seek guidance from a qualified financial advisor.

6. Building an Emergency Fund

Life is full of unexpected surprises, and having an emergency fund can be a financial lifeline during challenging times. Aim to set aside at least three to six months’ worth of living expenses in a liquid and easily accessible account. This fund can prevent you from falling into debt during emergencies, ensuring financial stability.

7. Retirement Planning: Secure Your Golden Years

Planning for retirement should not be procrastinated. The earlier you start, the more time your money has to grow through compounding. Consider contributing to retirement accounts such as a 401(k) or an Individual Retirement Account (IRA) and take advantage of employer-sponsored plans that offer matching contributions.

8. Insurance: Protecting What Matters

Insurance is an essential aspect of money matters, providing a safety net to protect you and your loved ones from unforeseen circumstances. Health insurance, life insurance, disability insurance, and homeowner’s or renter’s insurance are some of the critical policies you should consider having in place.

9. Avoiding Financial Pitfalls

To achieve financial success, it’s crucial to avoid common pitfalls that can derail your progress. Overspending, living beyond your means, and making impulsive financial decisions can be detrimental to your financial health. Cultivate mindful spending habits and focus on long-term goals rather than short-term gratification.

10. Seeking Professional Advice

If navigating money matters seems overwhelming, don’t hesitate to seek professional advice from financial advisors. An experienced advisor can help you assess your financial situation, set realistic goals, and develop a personalized plan to achieve them. Be sure to choose a reputable advisor who acts in your best interest and is transparent about fees.

Conclusion

Mastering your money matters is an ongoing journey that requires dedication, discipline, and continuous learning. By improving your financial literacy, budgeting effectively, saving diligently, managing debt wisely, investing thoughtfully, and planning for the future, you can attain financial success and peace of mind. Remember that every small step towards financial well-being counts, and with determination, you can build a secure financial future for yourself and your loved ones. So take charge of your money matters today, and embark on a path to financial prosperity!

by Andrea Carson | May 10, 2023 | SAVE MONEY

Getting a job offer is always an exciting time. Whether you’re getting your first job, a promotion, or changing careers, there’s a lot to be happy about. But it’s always wise to consider the financial aspect of any decision; starting a new job is no exception.

Before You Accept the Job

- Negotiate your pay. It never hurts to ask for a little more money. Respectfully asking for more money doesn’t cause any harm. Remember that any salary increase you can get now will only compound your future raises.

- Negotiating is the highest-paying activity you’re likely to take part in. Consider that a minute or two could result in thousands of dollars in additional income for many years. When did you last make that much money for a couple of minutes of work?

- Ask about the benefits. Typically, you’ll be told the general aspects of the company benefits. Be bold and ask for details. For example, some medical insurance plans are much more expensive than others. A job with a slightly lower salary might be much better when you have all the details.

After You Start Your New Job

- Deal with your previous 401(k). Roll the money into an IRA or your new 401(k). Resist the temptation to withdraw the funds; the tax penalties are significant. Ask your new human resources department about your options and make an intelligent choice.

- Keep your lifestyle in check. Just because you get a raise doesn’t mean you have to buy a more expensive house or car. You can save a lot of money if you can maintain your spending level for even one year. If you do increase your lifestyle, then be sure to bank at least part of your raise.

- Getting a raise is an excellent opportunity to save money or aggressively pay down your debt.

- Start paying yourself first. Set up your bank account with automatic savings of part of your increased income so you start saving money immediately. It will be easier to start saving now than later because you won’t miss money you’ve never seen.

- Ensure you’re withholding enough for taxes. It’s not financially wise to get a huge refund every year. On the other hand, it can be economically and psychologically challenging to pay more tax time. Be confident your withholding is enough to guarantee a small refund each year.

- Make benefit choices wisely. Set up your life, health, and disability insurance and other benefits intelligently for your own unique needs. Your life insurance needs will vary depending on your family situation. For example, the most expensive medical plan might not be the option you want if you’re young and in perfect health.

- Have your paycheck deposited into an interest-earning account. Interest rates are so low right now that it might not matter much, but depositing your paycheck into an account that pays interest makes sense. You can always transfer what you need into your checking account later.

Being financially healthy is the result of making wise decisions consistently. A job opportunity is a time for celebration; ensure you’re making positive financial moves to take your best advantage of this occasion.

by Andrea Carson | Mar 29, 2023 | SAVE MONEY

Although a million dollars isn’t what it once was, it would be a significant improvement for most of us. Additionally, if you can save a million dollars, you can keep two or three million. Are you able to make such savings?

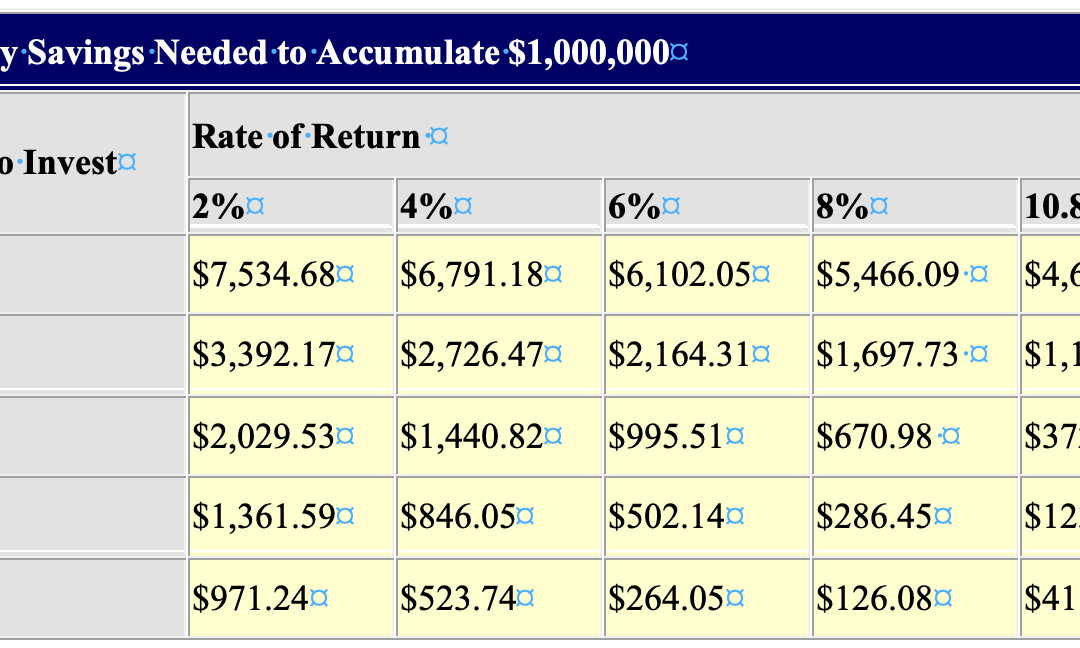

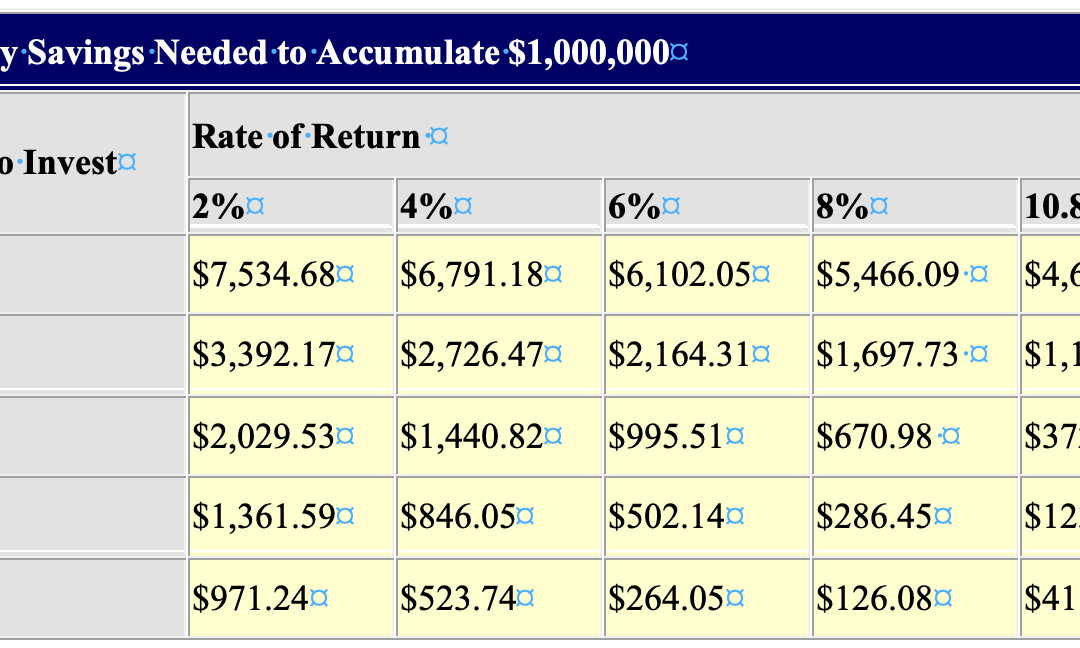

Everything is conceivable. Time is of the essence when it comes to saving a specific quantity of money. Let’s look at a table to determine how much money would need to be set aside each month to save $1,000,000:

As you can see, you need to save less money each month the earlier you start. To save a million dollars in 50 years, you just need to save $126.08 every month at an 8% return. But to achieve the same goal in 10 years, you must save roughly $5,500 every month. Ouch. It makes sense, but you’d be surprised at how much more you’d need to save if you waited.

Likewise, the rate of return grows more significant the longer the investment time is. Look at the 10-year time frame; the difference between the required savings amounts at 2% and 8% (around 38% more) isn’t that great. The difference between the two equivalent values at 50 years is just over 670%.

Thus it’s best to start saving as soon as you can and try to acquire the highest return rate possible.

But let’s be realistic—few of us have the insight to begin saving when we are 15 or 20. We constantly believe that there will be time for it later since we have more pressing matters to attend to.

Instead, let’s imagine that you have a 30 year time frame. Long-term, it is reasonable to anticipate a return of 10.8%; this is the historical return of the stock market. As you can see, that would necessitate $373 in monthly savings. We have now entered a zone that may be extremely realistic for you.

A few things to remember are:

- Employer matching contributions should be used. The first place to look for assistance is here. Your 401(k) matching contributions are like a raise. You will receive money from your employer in addition to pre-tax payments from yourself.

- Utilize accounts that are tax-deferred. The figures above presuppose that you are exempt from paying taxes on your profits as they accrue. This necessitates a concentration on 401(k), IRA, and comparable accounts.

- Don’t touch the money! In 30 years at a 10.8% rate, every dollar you save is worth $25.16. Over time, every dollar you spend will cost you a lot. Hence, that $20 trinket you simply must have ends up costing you more than $503.20. Always invest in items that you either either need or genuinely adore.

- Have patience. Towards the end, your savings increase significantly more quickly than they did at the beginning.

For the majority of people, saving a million dollars is easily doable. The main problem is time. Over time, even someone with a smaller income can build up significant wealth. This indicates that now is the moment to start, not tomorrow or even next year.

You’ll be happy with the outcomes if you start saving right away. While a million dollars may not be as valuable as it once was, it’s still not bad.