by Andrea Carson | Oct 11, 2023 | SAVE MONEY

Budgeting is a crucial financial tool that empowers individuals and households to manage their money effectively, achieve financial goals, and maintain financial stability. However, for many people, the thought of budgeting can be intimidating and overwhelming. The good news is that budgeting doesn’t have to be complex or stressful. In fact, simplifying your budget can make it more manageable and increase your chances of sticking to it. In this article, we’ll explore some practical tips on how to simplify your budget and take control of your finances with ease.

1. Start with Your Financial Goals

Before diving into the details of your budget, begin by setting clear financial goals. Whether you want to save for a vacation, pay off debt, or build an emergency fund, having a clear purpose for your budget will help you stay motivated and focused. Prioritizing your goals will make it easier to allocate your resources accordingly.

2. Track Your Income

Knowing how much money you have coming in each month is the foundation of any budget. Calculate your total monthly income, which includes your salary, bonuses, side income, and any other sources of cash flow. Make sure you are working with accurate figures to avoid surprises or discrepancies in your budget.

3. List Your Essential Expenses

Identify your fixed, non-negotiable monthly expenses such as rent or mortgage, utilities, insurance, and transportation costs. These are your essential expenses, and they should be allocated first in your budget.

4. Categorize Variable Expenses

Variable expenses include groceries, dining out, entertainment, and other discretionary spending. Categorize these expenses and set reasonable limits for each category. Consider using budgeting apps or spreadsheets to track your spending in real-time and ensure you stay within your budgeted amounts.

5. Consolidate Debt Payments

If you have multiple debts, such as credit cards, loans, or medical bills, consider consolidating them into a single, more manageable payment. Debt consolidation can simplify your budget by reducing the number of payments you need to track and potentially lowering your interest rates.

6. Embrace the 50/30/20 Rule

A straightforward budgeting guideline is the 50/30/20 rule. Allocate 50% of your income to needs (essential expenses), 30% to wants (variable expenses), and 20% to savings and debt repayment. This simple rule provides a balanced approach to managing your finances while keeping your budget uncomplicated.

7. Automate Savings and Bill Payments

Simplify your budget by automating your savings and bill payments. Set up automatic transfers to your savings account and schedule automatic bill payments through your bank or financial institution. This ensures that you never miss a payment and consistently save for your financial goals.

8. Build an Emergency Fund

An emergency fund is a financial safety net that can help you navigate unexpected expenses without derailing your budget. Start small by saving a portion of your income each month until you have built up at least three to six months’ worth of living expenses.

9. Review and Adjust Regularly

Your financial situation can change over time, so it’s important to review and adjust your budget periodically. Life events like job changes, marriage, or the birth of a child may necessitate adjustments to your budget. Make sure your budget aligns with your current goals and circumstances.

10. Seek Professional Help

If you find that your financial situation is particularly complex or you’re struggling to manage your budget effectively, consider seeking help from a financial advisor or counselor. They can provide expert guidance and help you simplify your budget to meet your financial goals.

Budgeting doesn’t have to be complicated or stressful. By following these simple steps and adopting a clear, organized approach to managing your finances, you can simplify your budget and take control of your financial future. Remember that the key to successful budgeting is consistency and flexibility – adjust your budget as needed to accommodate your evolving financial goals and circumstances. With a simplified budget in place, you’ll be well on your way to achieving financial peace of mind.

by Andrea Carson | Sep 6, 2023 | SAVE MONEY

Saving money to purchase your first home is a significant financial goal that requires careful planning and discipline. While it may seem daunting, with the right strategies and mindset, you can achieve your dream of homeownership. In this guide, we’ll provide you with practical tips to save money effectively for your first home purchase.

1. Set a Clear Savings Goal

Start by setting a specific and realistic savings goal for your first home. Determine how much you need for a down payment, closing costs, and other related expenses. Having a clear goal will motivate you to stay on track and make the necessary financial adjustments.

2. Create a Budget

Establish a comprehensive budget that outlines your income, expenses, and savings goals. Analyze your spending habits and identify areas where you can cut back. Allocate a portion of your income to savings every month, treating it as a non-negotiable expense.

3. Open a Dedicated Savings Account

Open a separate savings account exclusively for your home purchase funds. Choose an account with a competitive interest rate and no fees to maximize your savings growth. Having a separate account will prevent you from using the money for other purposes.

4. Automate Your Savings

Set up automatic transfers from your checking account to your dedicated savings account on payday. Automating your savings ensures consistent contributions without relying on willpower alone.

5. Reduce Discretionary Spending

Cut back on non-essential expenses, such as dining out, entertainment, and impulse purchases. Consider adopting frugal habits and finding more cost-effective alternatives for your everyday needs.

6. Increase Your Income

Explore opportunities to increase your income, such as taking on a part-time job, freelancing, or starting a side business. Extra income can significantly boost your savings progress.

7. Take Advantage of Employer Benefits

Check if your employer offers any savings or housing-related benefits. Some companies provide assistance programs or employer-matched contributions for first-time homebuyers.

8. Save Windfalls and Bonuses

Whenever you receive unexpected money, such as tax refunds, bonuses, or gifts, consider putting a portion or all of it into your home savings account.

9. Shop Around for Better Deals

When purchasing big-ticket items, such as furniture or appliances, shop around for the best deals and take advantage of sales or discounts.

10. Consider Down Payment Assistance Programs

Look into down payment assistance programs or grants available in your area. Some government agencies and nonprofit organizations offer assistance to first-time homebuyers, helping them bridge the gap for their down payment.

11. Avoid High-Interest Debt

Reduce or avoid taking on high-interest debt, such as credit card debt. Pay off existing debt as quickly as possible to free up more money for savings.

12. Stay Focused and Be Patient

Saving for a home takes time and discipline. Stay focused on your goal, avoid comparing yourself to others, and celebrate every milestone achieved along the way.

Conclusion

Saving money to purchase your first home is a significant accomplishment that requires careful planning, budgeting, and determination. By setting clear goals, creating a budget, and automating your savings, you can make steady progress toward homeownership. Reduce discretionary spending, increase your income, and take advantage of employer benefits to accelerate your savings. Remember, patience and consistency are key, and with dedication, you’ll be well on your way to achieving your dream of owning your first home.

by Andrea Carson | Apr 26, 2023 | SAVE MONEY

Children can benefit from financial education at an early age. Researchers share it’s crucial to start primary finance education by age 3. A study from the University of Cambridge, “Habit Formation and Learning in Young Children,” found that money habits are formed by age 7.

Children pick up money habits quickly, so giving them the right direction is crucial.

- Start with basic currency literacy. A study from Yale University found that children can recognize and remember coins by age 3.

- Educate your children about the different coins and dollar bills.

- Consider teaching them about foreign currencies during vacations. This will expand their minds and help them learn more about the countries you’re visiting.

- Create money jars. Money jars are a fun and easy way to educate your child.

- You can create three types of money jars for spending, saving, and giving, covering the fundamental lessons of understanding how to use money.

- Teach your children the three jars and why they’re essential.

- Use the jars to separate money after birthday gifts or allowance payments. Children will learn how to save for the future.

- Use the giving jar for charities. Children will learn about giving and understand how they can help others with their money. They can donate the funds to local animal shelters or food pantries.

- Use coupons. Coupons can provide an essential lesson on saving.

- Cut coupons with your children’s help and leave them in charge of handling the papers at the store.

- According to the Children’s Financial Network, kids as young as five can benefit from learning how to use coupons in a store. They will see how to save money and make wiser shopping decisions.

- Set a money goal. Children can set a money goal to purchase a favorite toy or other item.

- Money goals are an easy way to teach children financial patience. They also provide a lesson on how to save money.

- Setting realistic goals is essential, so children will be motivated to stay on a savings plan. If the toy they want is expensive, reaching their goals can take a while. Will they stay interested? Picking smaller and less costly targets is better.

- Go shopping. Let your children use their spend jars at the store to make purchases.

- How will your children spend their money? Will they use their entire jars at one store or spread them out over many shopping trips? Shopping provides an easy lesson setting.

- An outing to the local toy store also lets you discuss comparison shopping. Point out different prices on similar items and teach your children about finding inexpensive options.

- Evaluating the results of the shopping trip will help them understand their choices. How will they restock their spend jars?

- Use yard sales. Yard sales offer another way to educate children about finances.

- Yard sales can help you clean out your children’s rooms and teach them about money at the same time.

- Ask your children if they want to participate in the yard sale by selling their old toys or clothes. Help them select items they no longer use and find reasonable prices. They can use the experience to refill their money jars.

- Older children can help sell items at the sale. They can keep track of change and watch customers. This is also a valuable opportunity to learn about price negotiations with customers.

Finance education can begin before your children are in school. They need to understand basic money rules and form the proper habits.

by Andrea Carson | Mar 29, 2023 | SAVE MONEY

Although a million dollars isn’t what it once was, it would be a significant improvement for most of us. Additionally, if you can save a million dollars, you can keep two or three million. Are you able to make such savings?

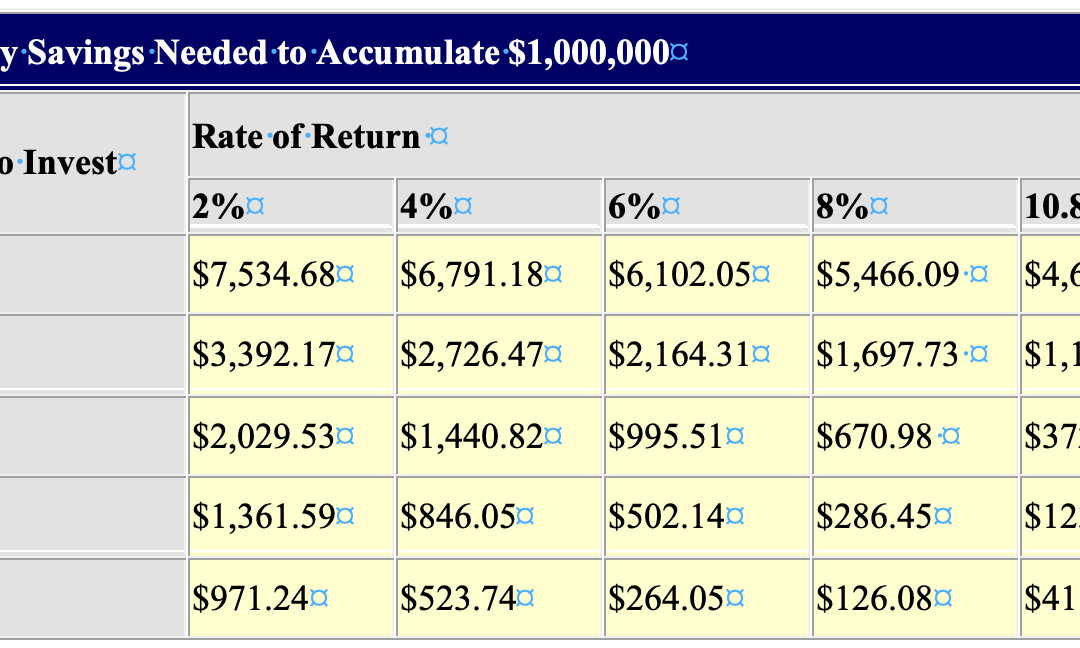

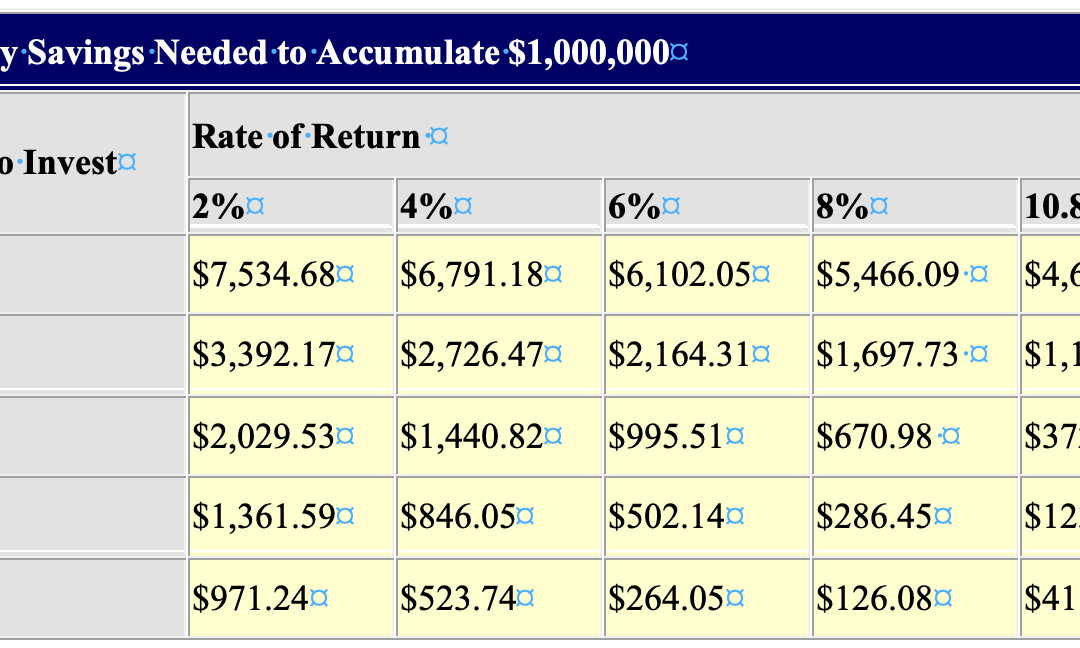

Everything is conceivable. Time is of the essence when it comes to saving a specific quantity of money. Let’s look at a table to determine how much money would need to be set aside each month to save $1,000,000:

As you can see, you need to save less money each month the earlier you start. To save a million dollars in 50 years, you just need to save $126.08 every month at an 8% return. But to achieve the same goal in 10 years, you must save roughly $5,500 every month. Ouch. It makes sense, but you’d be surprised at how much more you’d need to save if you waited.

Likewise, the rate of return grows more significant the longer the investment time is. Look at the 10-year time frame; the difference between the required savings amounts at 2% and 8% (around 38% more) isn’t that great. The difference between the two equivalent values at 50 years is just over 670%.

Thus it’s best to start saving as soon as you can and try to acquire the highest return rate possible.

But let’s be realistic—few of us have the insight to begin saving when we are 15 or 20. We constantly believe that there will be time for it later since we have more pressing matters to attend to.

Instead, let’s imagine that you have a 30 year time frame. Long-term, it is reasonable to anticipate a return of 10.8%; this is the historical return of the stock market. As you can see, that would necessitate $373 in monthly savings. We have now entered a zone that may be extremely realistic for you.

A few things to remember are:

- Employer matching contributions should be used. The first place to look for assistance is here. Your 401(k) matching contributions are like a raise. You will receive money from your employer in addition to pre-tax payments from yourself.

- Utilize accounts that are tax-deferred. The figures above presuppose that you are exempt from paying taxes on your profits as they accrue. This necessitates a concentration on 401(k), IRA, and comparable accounts.

- Don’t touch the money! In 30 years at a 10.8% rate, every dollar you save is worth $25.16. Over time, every dollar you spend will cost you a lot. Hence, that $20 trinket you simply must have ends up costing you more than $503.20. Always invest in items that you either either need or genuinely adore.

- Have patience. Towards the end, your savings increase significantly more quickly than they did at the beginning.

For the majority of people, saving a million dollars is easily doable. The main problem is time. Over time, even someone with a smaller income can build up significant wealth. This indicates that now is the moment to start, not tomorrow or even next year.

You’ll be happy with the outcomes if you start saving right away. While a million dollars may not be as valuable as it once was, it’s still not bad.

by Andrea Carson | Mar 22, 2023 | SAVE MONEY

Building up a healthy savings account is one of the finest methods to control your finances in today’s unstable economy. Nobody wants to experience the anxiety of being only one or two paychecks away from financial ruin due to a lack of reserves for when “something occurs.” Job loss, disability, car trouble, a sick child or pet, and other financial crises are specific instances. If you want to start small, this post will provide you with some saving tips:

-

Establish direct deposits into your savings account.

Setting up a monthly direct debit from your checking account to your savings account can allow you to save money over time without doing any extra work. This strategy can be beneficial when your savings accounts are set aside for specific objectives like creating an emergency fund, taking a vacation, or saving for a down payment on a house.

-

Total up your coins and tiny bills.

A more labor-intensive approach is to gather all the pennies and small bills you’ve collected throughout the day and place them in a savings envelope or jar. When you have a sizable sum, you can put it straight into your savings account and see your balance increase.

Using cash instead of credit cards when you want to monitor your spending makes sense because it might be more difficult to part with actual money. Although it takes time to accumulate funds, this method is suitable for steady savings development.

-

Be ready for your grocery store trips

You may save a lot of money on groceries by doing some preparation work before shopping.

Make a list of what you need and check your pantry before shopping to prevent impulsive purchases. Shop at supermarkets like Aldi and IGA that provide affordable prices.

Wherever feasible, choose locally farmed and seasonal produce. Flipping through the most recent fliers from your favorite grocer is simple; you could even find a coupon.

-

Reduce spending at restaurants and on takeout.

While eating out or ordering takeout is typically more expensive than cooking at home, cutting back on restaurant meals or food delivery is one of the easiest ways to increase your savings.

Aim to prepare breakfast and lunch at the very least if you frequently travel or eat out as part of your profession. You can choose starters or divide a main dish with your dining partner to cut dining costs. Also, skipping dessert and drinks can help you stretch your money.

-

Get entertainment discounts

Check your local calendar before splashing on expensive tickets to exclusive events; your neighborhood may offer free concerts and other live or recorded activities. To cut expenditures on entertainment, take advantage of free days at museums and national parks. Moreover, inquire about special savings for seniors, students, members of the military, and more.

-

Make substantial purchasing plans

You may save money by planning your purchases of gadgets, cars, appliances, furniture, and more around annual sale events like the end of the fiscal year or Boxing Day. Monitoring price changes over time makes it worthwhile to verify that a deal is indeed a deal.

-

Limit online purchases

To stop spending money on items you might not need, you might make it more difficult to purchase online. Choose to manually enter your shipping address and credit card number each time you place an order rather than keeping your billing information. Due to the added work, you’ll probably make fewer impulse purchases.

-

Postpone purchases according to the 30-day rule.

Giving yourself time to think before making a purchase is one way to stop yourself from going overboard.

If you’re shopping online, think about adding the item to your cart and leaving the page until you’ve had more time to examine it. (In rare circumstances, the shop may even give you a coupon code after discovering you abandoned the cart.) If 30 days seem excessively long, you might want to try shorter intervals, such as a 24- or 48-hour hold.

-

Be inventive with your gifts

With inexpensive gift suggestions like herb gardens and books, you may save money or do it yourself. Making a costly item doesn’t always show how much you care; sometimes, making cookies, creating art, or cooking for someone else does. Offering to accompany someone to a nearby (free) museum or another event is another way to give the gift of your time.

-

Reduce your auto expenses

Refinancing your auto loan and taking advantage of lower interest rates could result in significant savings throughout your term. You can save on continuing car maintenance expenditures by driving less, removing heavy objects from your boot, and avoiding needless quick acceleration. Regular comparison shopping for auto insurance can also help you save money compared to letting your current policy automatically renew.

-

Lessen your use of gasoline

In addition to using public transportation when possible, there are other things you can do to reduce your gas consumption and save money since you have no influence over gas prices at the pump. To check fuel costs and find the lowest fuel available, try utilizing a mobile app like Fuel Map or Petrol Spy.

-

Combine the internet with paid TV.

Consider combining many services under one plan to reduce your internet, pay TV, or streaming bill. For instance, Foxtel’s Broadband + Platinum Plus bundle offers a Foxtel subscription and high-speed internet.

Cutting ties with subscription TV and sticking with cheaper streaming services like Netflix and Stan is an additional choice. It’s worthwhile to consider how frequently you watch each service or downgrade to versions with advertisements if you want to minimize expenditures further.

-

Change your mobile plan

Changing your plan is one method to save money on your mobile phone bill, but it’s not the only way.

-

Lower your monthly electric bill

You can save hundreds a year on your electric bill by making significant and tiny changes to your energy use. Consider adopting intelligent power strips, replacing older appliances with more energy-efficient models, switching to a smart thermostat, and fixing any insulation gaps in your home. Over time, even small reductions in your monthly electricity usage can result in significant savings.

-

Terminate any unused subscriptions

Refinancing could save you several hundred dollars a month if you can get a lower interest rate on your house loan. While some upfront costs are associated with refinancing, they can be recovered over time if you start making lower monthly payments.

-

Set financial targets

Establish a precise but doable objective. The goal can be to “pay off my credit card debt quicker” or “contribute $5,000 to my super fund account this year.” Calculate how much you need to save monthly or yearly to achieve your goal.

-

Track expenditures

Consider using a budget trackings tool like MoneyBrilliant, GoodBudget, or Frollo. Observe the difference between your monthly revenue and expenses or your cash flow. Furthermore, this step will simplify tracking advancement toward your savings objective.

-

Repay debt with a high-interest rate

Debt payments can put a tremendous strain on your overall spending plan. The general interest paid will be reduced if you can pay off high-interest debt more rapidly by making extra payments utilizing the snowball or avalanche methods. You will also be relieved of that load sooner. Start saving the money instead after that.

-

Save money in a high-yield savings account

Invest your growing earnings in a high-yield online savings account to get the most out of your money while you work toward your financial objectives. Interest rates at some of the top neobanks and digital banks can be greater than those at traditional central banks.

-

Following a budget, which entails establishing goals for your spending, is one wise method to manage your money and ideally retain more of it.

The future is incredibly unpredictable, making it challenging to foresee the circumstances we may encounter in the days and years to come. Because of this, it becomes crucial and vitally necessary to invest and save money intelligently and sensibly.